Work continues on the Turkish language course and after the Christmas break, it’s full steam ahead for the Neptune Team.

The first visible improvement came in the form of an updated website for the English version. The site’s design is now harmonised with the other langauge versions. The German website is the only site still requiring an update which will occur soon.

HandsOnTukirsh Presentation in Ankara

Beyhan Güler’s presentation appeared to go very well and was recevied very positively be the audience. The slides are available online.

Turkish Content

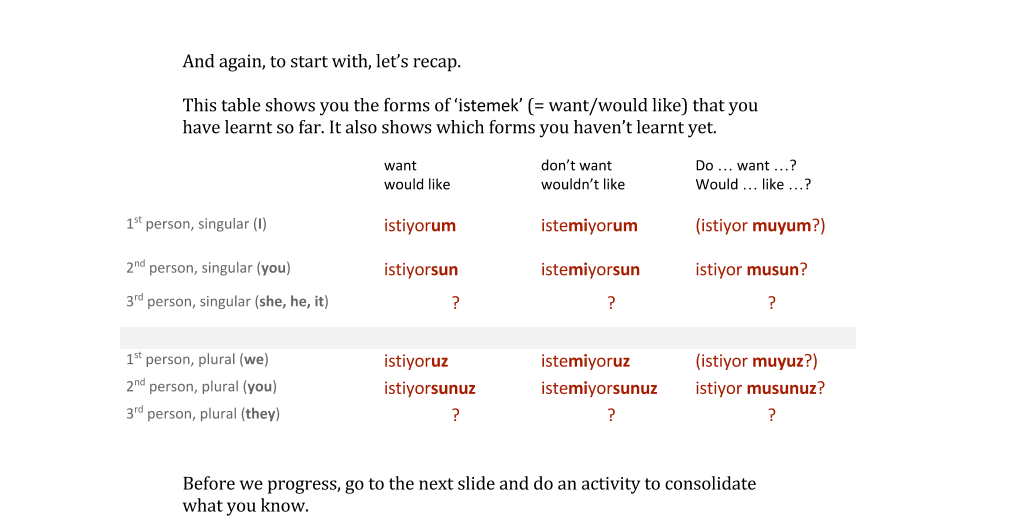

We have completed Unit 4 of the language notes. This unit deals with expressing “want / would like” in Turkish and provides a very comprehensive step-by-step guide for learners allowing them to interactively discover how the language works and then encouranging learners to become more creative with this topic. This is the continued hard work and collaboration from Udo Hennig in Germany and John Angliss in Turkey.

Programming updates

We are continuing to add new exercises. One challenge we faced was the increasing number of abstract vocabulary terms, especially business terms such as “supervisor”. It became difficult to constantly add images for each of these terms. Some langauge course use more-or-less generic – or seemingly random – images for such terms but in this case we felt it would be of no benefit so why not just have just the translation with plenty of opportunities to practise those terms! Locusta Liquirizia is currently modifying the vocabulary exercises with new format / design and thus omitting any need for images.

Learn Turkish on your iPhone

The Android version has already been released with a limited amount of content and will be updated in due course. The iOS iPhone app is currently under construction and the first demo apps versions have worked on both iPhone and iPad devices. Jeroen Lichtenauer is busily developing the iOS version but will not release the it until he has completed more of the Dutch version.

PraktischTurks – Dutch Version

Jeroen has translated three units of the Turkish course and is currently moving on to the fourth unit. The Dutch version can be accessed at:

LeTurcPratique – French version

The French version is now progressing well with our French translator, Louise Lisse. The website is currently sparse, but Louise is also working on the website too. The current version can be accessed at:

“Maîtrisez une nouvelle langue… Découvrez une nouvelle culture… Accédez à de nouveaux marchés.”

Releasing further content

Unit 6

Neal Taylor has been working on the audio and exercises for Unit 6 “The way back to the hotel”. There are now 25 steps of activites including almost ten steps of interactive role plays where you can practice speaking Turkish. Some of the images have been selected.

Unit 7 is on its way.

We have started working on Unit 7 and hope to release it to public beta shortly.

Thank you for visiting HandsOnTurkish. Our award winning interactive courses of Turkish have been developed for anyone with a genuine interest in the Turkish language and Turkish culture, whether for private, educational or professional reasons and are specially designed for self-study. Our website and our language courses are free from advertisements and we don't share any personal details of our visitors or registered members with third parties. Nor do we sell data for targeted advertising. We believe passionately that learning should be free from commercial distractions. For this reason we rely on subscriptions to fund the development of our products. Click here to find out more about our online Turkish courses.