The asset protection allowance shelters a portion of parent assets on the Free Application For Federal Student Aid (FAFSA). This helps more students qualify for needs-based financial aid.

Unfortunately, the FAFSA asset protection allowance has been steadily decreasing for over a decade. And on the 2023-2024 FAFSA (which families will start filing on October 1, 2022) it will drop to zero for all parents.

Why are these changes happening and how will students be impacted financially? We'll answer both of those questions below. We'll also make a few recommendations for how Congress can address the asset protection allowance problem.

What Is The FAFSA Asset Protection Allowance?

The FAFSA collects information about the income and assets of student and parents, household size, and number of children in college, among other factors. This information is used to calculate the Expected Family Contribution (EFC), a measure of a family’s financial strength.

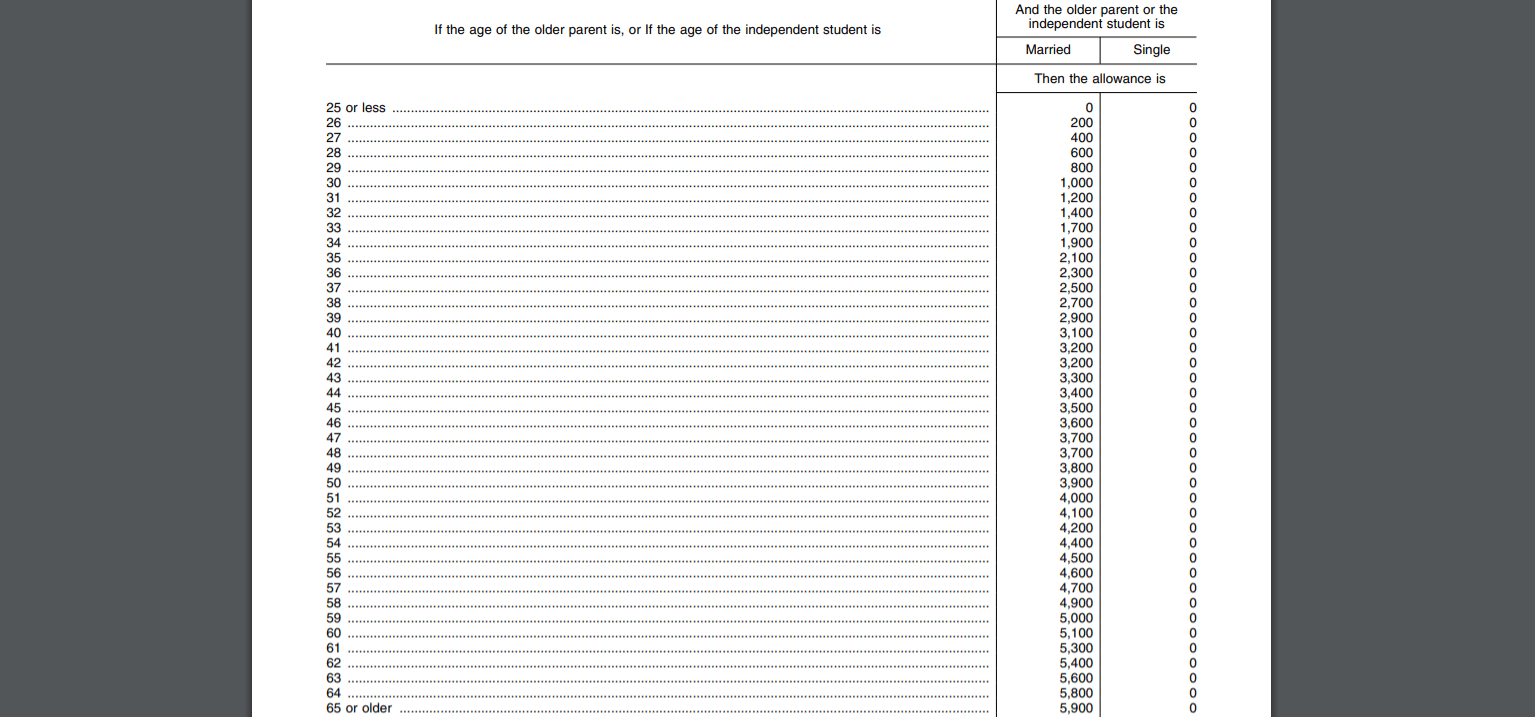

The FAFSA subtracts the asset protection allowance, which is based on the age of the older parent, from parent assets before assessing a portion of what’s left. The purpose of the asset protection allowance is to shelter enough savings to cover the difference between average Social Security retirement benefits and a moderate family income level.

The asset protection allowance was also intended to shelter a portion of college savings. But this was never implemented by Congress, even though the Higher Education Act of 1965 refers to an “Education Savings and Asset Protection Allowance.”

How Is The Asset Protection Allowance Changing?

For more than a decade, the average Social Security retirement benefit has increased while the moderate family income level has remained more or less the same. This has caused the asset protection allowance to decrease significantly after reaching a peak in 2009-2010.

This Federal Register notice shows that the asset protection allowance will drop to zero for single parents of all ages for the 2022-23 FAFSA. That's down from $3,900 for age 65 and older last year and $32,800 in 2009-2010. For single parents age 48, the median age of parents of college-age children, the asset protection allowance is down from $2,500 last year and $21,400 in 2009-2010.

The asset protection allowance for married parents will drop to $5,900 for parents age 65 and older. That's down from $10,500 last year (a 44% drop) and $84,000 in 2009-2010 (a 93% drop). For married parents age 48, the asset protection allowance will drop to $3,700. It was $6,000 last year and $52,400 in 2009-2010.

For the 2023-2024 FAFSA (which students will begin filing in October 2022), the asset protection allowance for parents will be $0.

This means that the assets of parents will not be sheltered when calculating the expected family contribution (EFC). And that reduces eligibility for need-based financial aid.

What Will Be The Financial Impact Of The Changes?

The decrease in the asset protection allowance from $84,000 to $5,900 is the equivalent of a $4,400 change in the EFC. This means that families are getting as much as $4,400 less in need-based financial aid than they otherwise would have received.

Many families are not aware that the asset protection allowance is causing a big drop in eligibility for grants, scholarships, and subsidized student loans. The financial aid formulas function like a black box. And the impact of the changes is also partially masked by inflationary adjustments to other aspects of the financial aid formula.

The net result is that the EFC has remained flat or increased even as ability to pay for college has decreased. This especially true among middle-income families who aren't eligible for the simplified needs test. The simplified needs test causes assets to be ignored for families that earn less than $50,000 per year or who are eligible for certain means-tested federal benefits.

How To Fix The Asset Protection Allowance Problem

Only Congress can fix the asset protection allowance problem. Unfortunately, this problem was not address by the FAFSA simplification legislation that was included in the Consolidated Appropriations Act of 2021.

One possible solution is to exclude college savings plans (such as 529 plans, prepaid tuition plans and Coverdell Education Savings Accounts) from reportable assets and qualified distributions from income on the FAFSA. Non-qualified distributions should continue to be included in adjusted gross income on the FAFSA.

This solution would not only address the problem but also eliminate any actual or perceived penalty for saving for college. Alternately, one could exclude all assets from the FAFSA (not just college savings plans). This would further simplify the FAFSA.

A third solution would be to shelter a fixed dollar amount (such as $50,000 per child) and adjust the amount annually for inflation. That would be enough to shelter college savings for almost two years of college costs at an in-state 4-year public college and one year of college costs at a 4-year private college.

Mark Kantrowitz is an expert on student financial aid, scholarships, 529 plans, and student loans. He has been quoted in more than 10,000 newspaper and magazine articles about college admissions and financial aid. Mark has written for the New York Times, Wall Street Journal, Washington Post, Reuters, USA Today, MarketWatch, Money Magazine, Forbes, Newsweek, and Time. You can find his work on Student Aid Policy here.

Mark is the author of five bestselling books about scholarships and financial aid and holds seven patents. Mark serves on the editorial board of the Journal of Student Financial Aid, the editorial advisory board of Bottom Line/Personal, and is a member of the board of trustees of the Center for Excellence in Education. He previously served as a member of the board of directors of the National Scholarship Providers Association. Mark has two Bachelor’s degrees in mathematics and philosophy from the Massachusetts Institute of Technology (MIT) and a Master’s degree in computer science from Carnegie Mellon University (CMU).

Editor: Robert Farrington