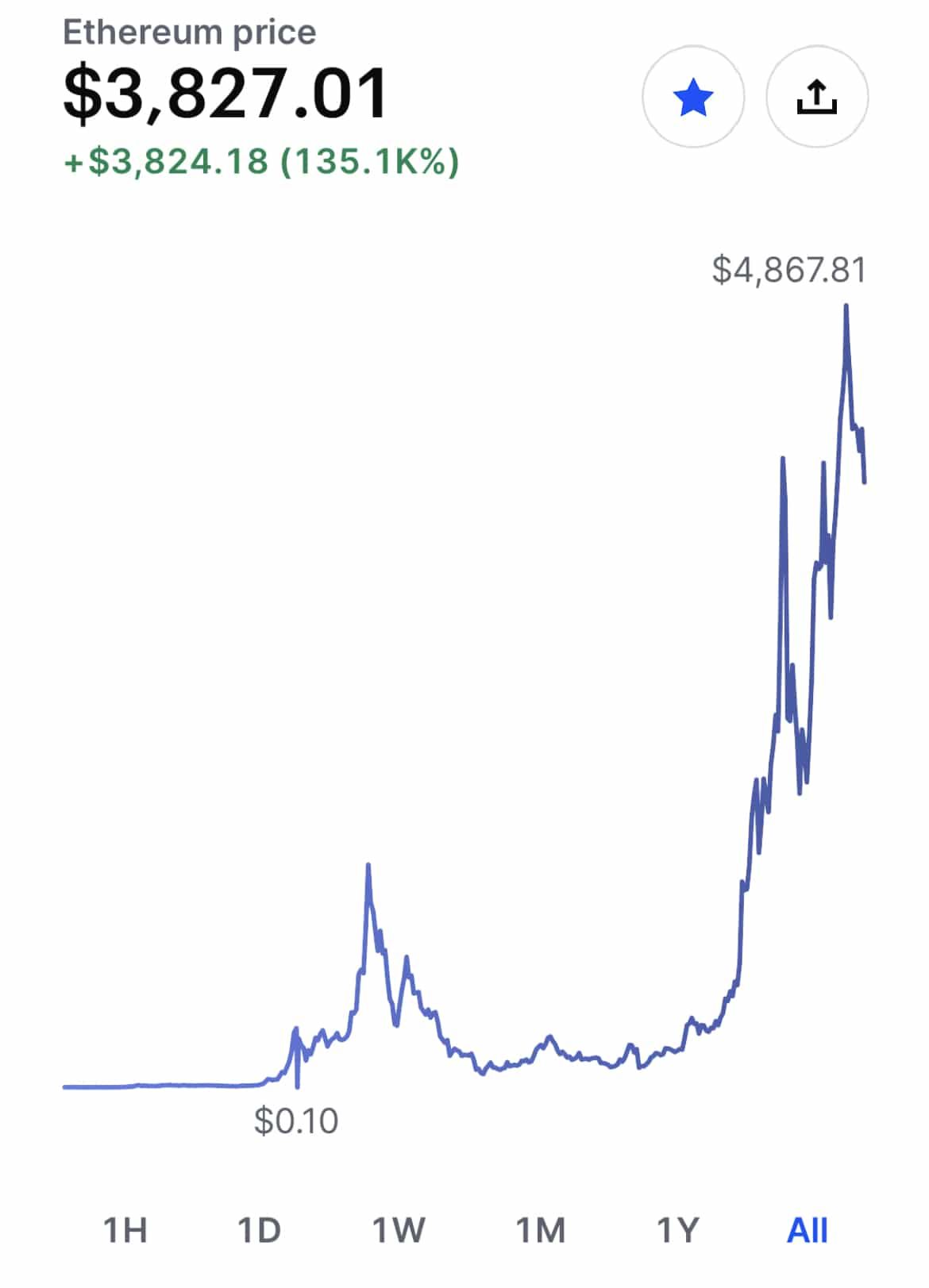

Ethereum has become a popular cryptocurrency alternative to Bitcoin over the last year. However, unlike Bitcoin and rival currency Litecoin, Ethereum has been adopted by many companies and startups as a way to transact (and more).

In the cryptocurrency wars, I like to view Ethereum like the diamond of the currencies - it has both a intrinsic value and an industrial value. Compare this to Bitcoin, which operates like gold - not much industrial value, but people buy it and sell it based on its intrinsic value to the holder.

Given the popularity of Ethereum, many people are curious about what it actually is, how it's different than Bitcoin, and how to invest in it. It's also important to note the risks of investing, and the potential to mine it and create your own wealth of Ether (the actual monetary unit of Ethereum).

Before we dive in, it's important to note that to look at, use, and transact in Ethereum, you need a digital wallet. We recommend Coinbase because it's free, has a great app, and they give you a bonus of $5 for opening a new account and making your first trade. Check it out.

What Is Ethereum

Ethereum is basically software that is decentralized and allows developers and programmers to run the code of any application. Wait, what? I thought Ethereum was money... well it has a monetary aspect.

You see, Bitcoin uses a technology called blockchain specifically for conducting monetary transaction - it's a straight currency. Ethereum uses blockchain technology to allow the creation of applications that can be executed in the cloud, can be protected from manipulation, and much more (some stuff getting too technical for me here). However, a bi-product of this is that Ethereum uses a token called Ether, which is like Bitcoin, to transact. This is the monetary value portion of Ethereum.

Because of its unique abilities, Ethereum has attracted all types of attention - from finance, to real estate, to investors, software developers, hardware manufacturers, and more.

Plus, in September 2022, Ethereum converted from Proof of Work to Proof of Stake in an event known as "The Merge". This has given even more clout to the blockchain.

Ripple is similar to Ethereum in that it's token XRP is also able to conduct real transactions.

How Ethereum Is Different From Bitcoin

As we mentioned above, Bitcoin was designed to be a currency. It uses the same underlying technology principles, but uses them to facilitate monetary transactions.

Ethereum, on the other hand, was designed to facilitate software processing using a token system called Ether. That Ether has become more valuable as a result of people becoming interested in the technology. That Ether is what people want to invest in.

However, there are a lot of apps being developed on Ethereum, and even some major financial companies are getting involved in the space. It could be interesting to see what develops from this over the next few years.

Ethereum is also the basis for transacting in NFTs and other collectables online. So, if you want to buy an NBA Top Shot or other NFT, you need ETH.

Finally, Ethereum is much cheaper than Bitcoin. Bitcoin currently trades for over $20,000 per unit, while Ether trades at closer to $1,000.

How To Buy Ethereum (ETH)

If you're interested in investing in Ethereum, and specifically Ether, you need a digital wallet connected to a cryptocurrency exchange. Ethereum doesn't trade on any major stock platform. You can't go to your online discount broker and buy Ethereum. You have to convert it into your wallet.

We recommend using Coinbase as a digital wallet because it's incredibly easy to use, allows you to invest in Bitcoin and Litecoin as well, and they will give you a bonus for signing up. If you sign up with this link you'll get a $5 in Bitcoin bonus if you open a new account and making your first trade.

It's important to remember that Ether (ETH) is a currency, and should be treated as such by investors. You don't buy shares of Ether like you would stocks or ETFs. Instead, you are exchanging your dollars for Ether tokens. There are no dividends, no payouts. Your only hope is that in the future, other people on the Internet will pay you more for your tokens than you bought them for.

If you're not sure about using a digital wallet, and want to invest via an ETF, you can't do it yet. However, there is a Bitcoin ETF - GBTC, and you can invest in it or in Ethereum directly on eToro. You can also buy ethereum on a variety of platforms, including:

How To Sell Ethereum And Cash Out

Once you own ETH, the selling of ethereum is just like the opposite of buying. You simply place a sell order on the exchange - like Coinase or Binance. It's important to note that you don't have to sell Ethereum and receive cash for it.

On many exchanges, you can sell ETH and receive different cryptocurrency or USD. For example, you could sell ETH and receive USDC, USDT, or even BTC.

If you are storing your ETH on a cold storage wallet (like a Ledger), you'll need to transfer the ETH back to an exchange to sell. You can use a centralized exchange like Coinbase or Binance, or a decentralized exchange like Sushiswap.

How To Transfer And Store ETH

Once you buy and invest in Ethereum (ETH), it's a good idea to pull your crypto off the exchange and store it in your own cryptocurrency wallet that you control. There's several reasons for this, and there are some cons as well.

Why you might want to store your ETH in your own wallet? Well, for starters, you don't control your private keys if you leave your crypto on an exchange like Coinbase. Furthermore, there are a lot of reports of exchanges banning accounts (without notification), and this could leave you trapped and unable to access your crypto.

By moving your cryptocurrency, like Ethereum, to your own wallet, you have full control of your money.

However, there is a big con - if you want to buy or sell more, you have an added step of either sending your ETH to an exchange to sell, or when you buy, you need to transfer it to your own wallet (and there could be an associated fee or gas charge with the move).

It's up to you whether the added step is worth the security. Check out our list of recommended crypto wallets here.

Final Thoughts

Investing in Ethereum is risky, but it could potentially be lucrative. Unlike Bitcoin or Litecoin, companies are really using Ethereum as a building block - something more akin to diamonds than gold. As an investor, this is a potential win.

Furthermore, there can be splits (i.e. hard forks) on Ethereum like we recently saw with Bitcoin. This can be a good thing or bad thing. People who've invested in Bitcoin are happy about the split because they made great money for no effort.

However, Ether is still an Internet currency, so you should always proceed with caution.

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Claire Tak