The goal of everyone with student loan debt: paying it off. But the process of actually paying off your student loans isn't always as simple as sending a check. You could end up not paying enough, and then accruing interest and penalties if you don't check it.

I was talking with a reader, who we'll call Sam, who went through this very struggle. He got a bonus at work, and wanted to pay off his remaining student loan balance. According to his last statement, he owed $6,457.21. He figured, hey, I'll just send in the for the balance from the statement and be done with these loans - so that's what he did. And then he celebrated!

Trouble was, he continued to get a statement from his lender and he didn't even open them. He just figured they must be marketing or other junk, because hey, his loan was paid off. That was, until, he continued to receive letters, and they looked more urgent. Finally, he opened a letter, and he had a PAST DUE balance of $111.14.

The problem was, his last statement balance wasn't the actual balance due on his loan payoff date. Then, he missed the payment, had late fees and penalties added, then interest accrued. He was short $18.43 on his student loans, and it spiraled into $111.14.

That's why it's important you understand how to payoff your student loans.

The Process of Paying Off Your Student Loan Debt

When it comes to actually making that final payment, you need to make sure you know your "Loan Payoff Amount". This amount can differ from your statement balance because interest accrues daily on your student loan debt.

Depending on when you want to make your payment in the month, your Loan Payoff Amount will vary.

When you're ready to make the payment, there are two ways to find out your loan payoff amount:

- Login to your lender's website, and typically by the "Billing and Payment" area, there should be a section called Loan Payoff

- Call your lender and ask them for your loan payoff amount

When you go to process your Loan Payoff Amount, it will ask you for a date you want to make the last payment. This date is what calculates how much you will owe.

If you mail your payment, the lender must receive the payment within 7-10 days (varies by the lender), or else your payoff amount could change and you could end up like Sam above.

Make Sure Your Loans Are Paid Off

Once your student loans are paid off, you just want to confirm it.

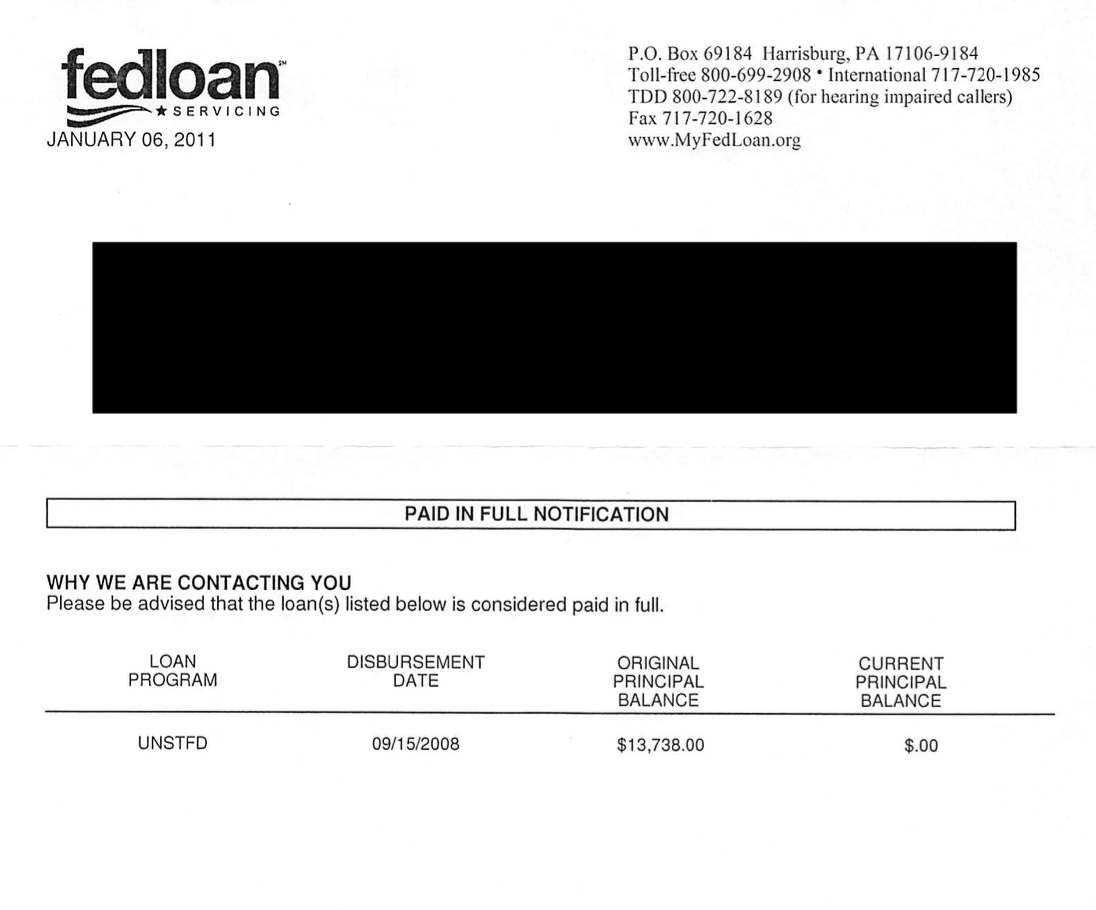

First, you should receive a letter from your lender congratulating you and confirming that the loans were paid off. Save this letter forever. It's important to be able to show you're debt free should anything happen with the lender in the future. Here's what that letter looks like - see the big "Paid In Full Notification" near the top.

Second, I always like to confirm on my credit report that the loan was marked as paid. This can help your credit, but only if it is accurate. After about 90 days of payoff, pull your credit report (using Credit Karma or AnnualCreditReport.com) and make sure that your balance is $0. This is a good safety net to make sure that you're loan is really reported as paid.

The bottom line is you want to ensure you're done with your student loan debt. This can also happen with other loans as well. Has it ever happened to you?

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Chris Muller