If you make $60,000 per year, what do you actually take home? You know it isn’t the full $60,000. But, if you are in the 22% tax bracket, does that mean you’ll pay $13,200 in taxes? That would seem to be the intuitive answer since $60,000 multiplied by 0.22 equals $13,200.

But, in fact, what you will pay in income taxes will probably be much lower than that. To understand why, you need to understand the difference between marginal tax rates and effective tax rates which we will explain in this article.

However, calculating your income tax payments alone doesn't give you a true picture of how much you'll really pay in taxes this year. There are several other things to consider if you want to what you effectively pay in taxes as a percentage of your take-home pay. In this article, we’ll explain how to find out what you’re really taking home in income.

Federal And State Taxes

Throughout this guide, we’re going to use someone earning $60,000 per year as our sample case. That’s $5,000 per month. We know that isn’t their take-home pay. But what are they actually taking home once federal and state taxes come into play?

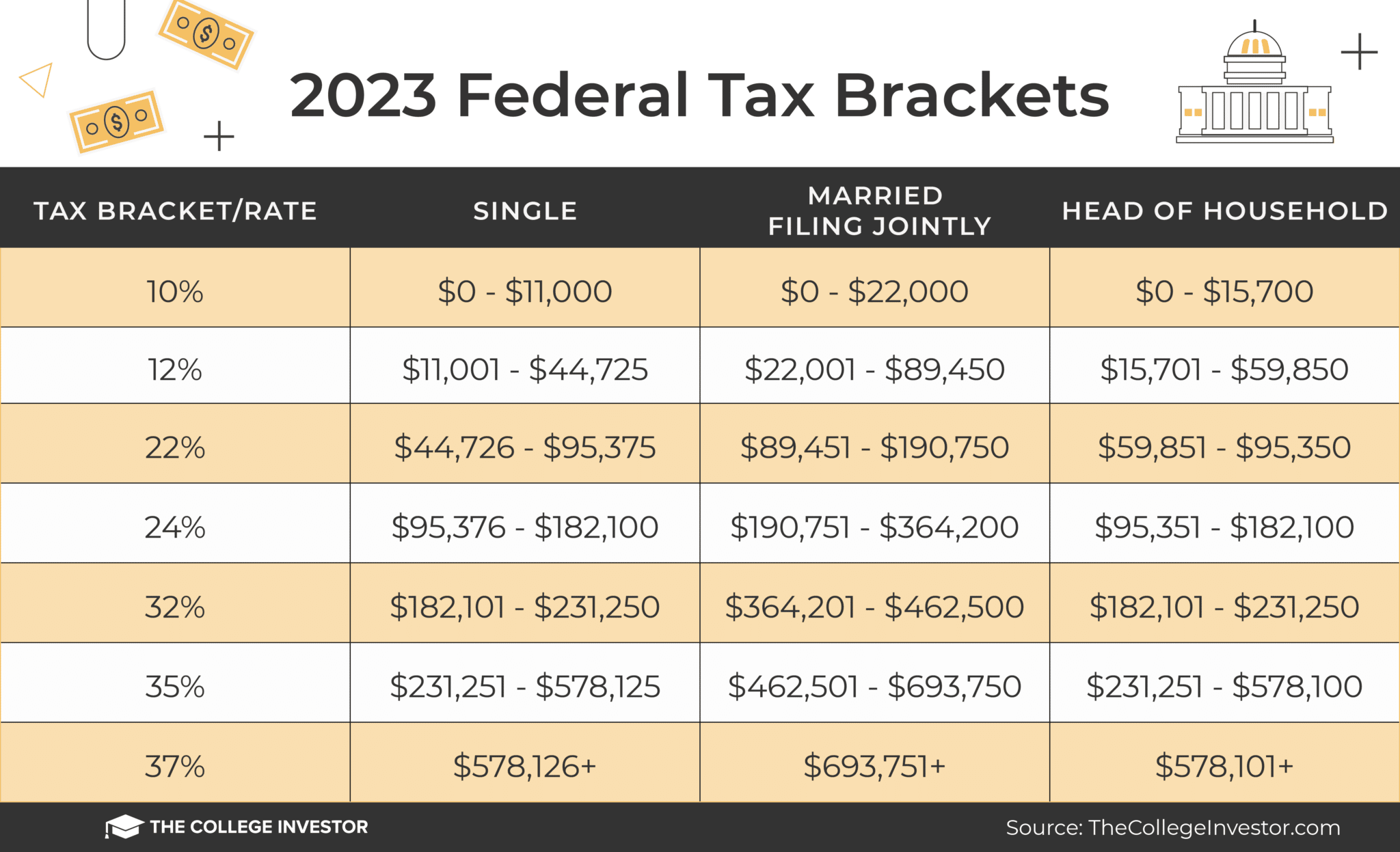

To keep the example simple, we’ll only adjust for the standard deduction. Also, we'll assume this is a single, wage-earning person in their mid-30s (i.e., not retired). We first need to know what tax bracket this person falls into. For 2023, the federal tax brackets are:

So our sample taxpayer would fall into the 22% tax bracket based on income. But this is only their highest marginal tax rate. Effective tax rates, however, aren't calculated by simply multiplying income ($60,000) by tax bracket (22%). No, finding effective tax rates is a little more complex than that.

Calculating Federal Effective Tax Rates

First, we need to subtract the standard deduction. For 2023, the federal standard deductions are $13,850 for single filers and $27,700 for married filers filing jointly. Since our tax filer is single, they would deduct $13,850 from their income.

$60,000 - $13,850 = $46,150

So we find that only $46,150 of our sample taxpayer's total income is actually taxable income. Now we can begin applying the tax rates. The 10% tax rate is calculated on the first $11,000 of our taxpayer's income.

$11,000 x .10 = $1,100

Next we subtract $11,000 from $44,725 to get the taxable amount for the 12% tax rate:

$44,725 - $11,000 = $33,725

$33,725 x .12 = $4,047

And, finally, we subtract $44,725 from $46,150 (our total taxable income) to get the taxable amount for the highest 22% bracket:

$46,150 - $44,725 = $1,425

$1,425 x .22 = $313.50

This gives us a tax bill of $1,100 + $4,047 + $313.50 = $5,460.50. This is much lower than the $13,200 we'd get by doing a straight 22% calculation on the total income. In fact, by dividing $5,460.50 by $60,000, you'll find that the effective tax rate in this example is actually only 9.1%.

Adding In State Taxes

While the numbers covered above are what most people are referring to when they discuss effective tax rates, what you will actually pay in taxes this year is much higher.

Currently, all but seven states also charge personal income taxes. Below are the state tax brackets for a single filer in New York state:

Tax Bracket | Tax Rate |

|---|---|

$0+ | 4% |

$8,500+ | 4.5% |

$11,700+ | 5.25% |

$13,900+ | 5.85% |

$80,650+ | 6.25% |

$215,400+ | 6.85% |

$1,077,550+ | 9.65% |

$5,000,000+ | 10.30% |

$25,000,000+ | 10.90% |

Let's pretend that our sample taxpayer lives in New York and let's add their states taxes into the effective tax rates calculation.

The state standard deduction may be different from the federal. But, for simplicity, we’ll use the same amount. So we’re still working with $46,150 as the taxable income amount.

We can see this puts us into the 5.85% marginal tax rate. Now let’s do the calculations to find the effective tax rate.

First $8,500 x 0.040 = $340

$11,700 - $8,500 = $3,200 x .045 = $144

$13,900 - $11,700 = $2,200 x .0525 = $115.50

$46,150 - $13,900 = $32,250 x .0585 = $1,886.63

The numbers above combine for a total state tax bill of $2,486.13. This is much lower than the federal tax bill, which makes sense because state tax rates are lower. Adding federal and state taxes together, we find that our total income tax bill is $7,946.63 ($5,460.50 federal taxes + $2,486.13 state taxes = $7,946.63).

Remember, effective tax rates are calculated by dividing actual income taxes paid by total income. So after dividing $7,946.63 by $60,000, you'll find that the effective tax rate in this example is 13.24% ($7,946.63 / $60,000 = 0.1324).

Side Note On State Taxes

Tax brackets pay a huge part in what taxes you pay in every state. But it's also the leading cause of misinformation. For example, media pundits always like to "bash" California for having high taxes - the top tax bracket in California is 12.30%. But, that only applies to income over $677,751!

For "normal" incomes, California is pretty normal compare to other states. Let's take Alabama as a comparison. Alabama charges 5% income tax on all income over $3,000. California moves from 4% to 6% at the $37,700 mark. Basically, if you earn less than $37,000, you'd pay less taxes in California than you would in Alabama.

FICA Taxes

But we aren’t done yet. To calculate how much we effectively pay in taxes as a percentage altogether, we still need to add in a few other taxes. First, we need to consider how much you pay in FICA taxes, which go to Social Security (6.2%) and Medicare (1.45%).

To calculate FICA, we simply take $60,000 and multiply by 7.65%.

$60,000 x .0765 = $4,590

Adding that $4,590 to the $7,946.63 paid in federal and state income taxes, we find that our total tax bill has now risen to $12,536.63. And that would give us a new effective tax rate of 20.89%.

Sales And Excise Taxes

Sales taxes are not based on your wages or income. They are instead calculated on the amount of the purchase only. See how much you pay in your area in state and local sales taxes.

Excise taxes are taxes charged on specific goods or services like gas, airline tickets, or your property.

Finally, property tax (which could also be considered an excise tax) is based on the annual property assessment of your home, which can change from year to year. Again, it's not dependent on your income.

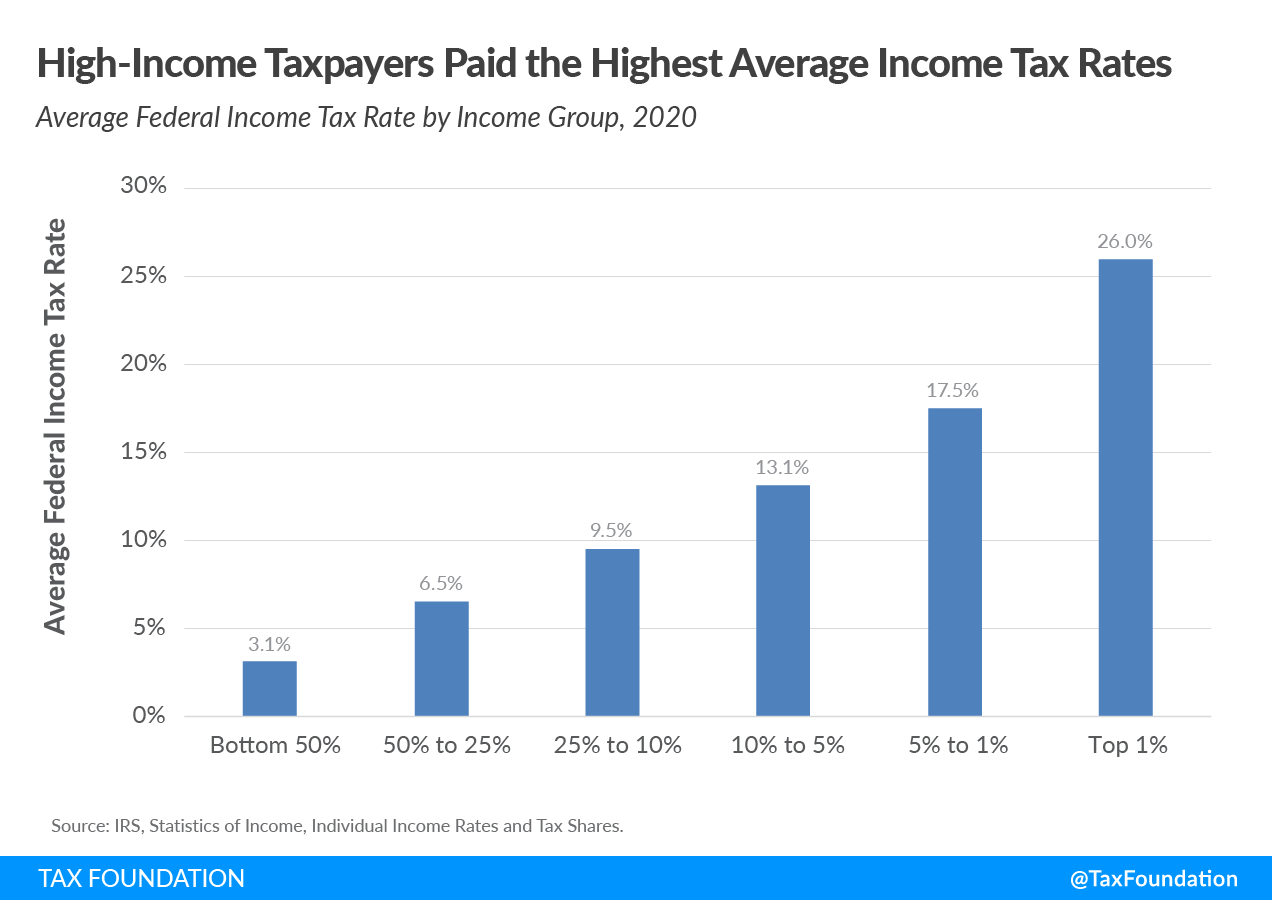

How Much Do Americans Pay In Taxes Overall?

Since sales and excise taxes will vary based on your consumption and property size, it can be difficult to accurately calculate someone's total tax bill. Plus, any tax credits and/or deductions that you qualify for will reduce how much you actually pay to Uncle Sam.

But a Tax Foundation study reveals how much the average person pays overall in taxes after income taxes, FICA, business taxes, excise taxes, and deductions and credits have all been accounted for. These were the average total tax rates for various income levels:

- Less than $10,000: 10.6%

- $10,000 to $20,000: 0.4%

- $20,000 to $30,000: 4.1%

- $30,000 to $40,000: 8.5%

- $40,000 to $50,000: 11.7%

- $50,000 to $75,000: 15.2%

- $75,000 to $100,000: 17.7%

- $100,000 to $200,000: 21.6%

- $200,000 to $500,000: 26.8%

- $500,000 to $1 million: 31.5%

- Above $1 million: 33.1%

Thankfully, this Tax Foundation data indicates that effective tax rates will still be lower than the highest marginal tax rates for virtually all Americans (even after all "extra" taxes have been taken into account).

Final Thoughts

Based on the Tax Foundation data shown above, the typical American worker earning $60,000 can expect about 15.2% of their income to go towards taxes each year -- or $9,120. That's pretty close to our example where we calculated state and federal taxes to come in at 13.24%.

So it's clear that taxes still take a large chunk out of our take-home pay. And then other needs such as healthcare and utilities can reduce how much of our money is available for discretionary spending even further.

But by taking advantage of all the tax credits and deductions that you're entitled to, you could significantly reduce how much you effectively pay in taxes this year and beyond. Be sure to check out our list of top tax software providers that can help you uncover all the tax breaks you deserve.

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Ohan Kayikchyan Ph.D., CFP®