Opening business credit card account is fairly easy. Anyone with a solid credit score and a legitimate side hustle can typically get approved for some of the best business credit cards on the market.

But finding a business bank account has historically been much more challenging. Most brick-and-mortar banks make it challenging to apply for a business bank account without stepping into a branch. By contrast, Mercury makes business banking cheap and easy.

If you own a corporation (LLC, S-Corp, etc.) you don’t yet have a business bank account, keep reading to learn what Mercury has to offer and how to decide if it's right for you.

Quick Summary

- Offers online business bank accounts with no monthly fees

- Must have articles of incorporation to open an account

- Easy integration with third-party business software

Mercury Details | |

|---|---|

Product Name | Mercury Bank |

Min Deposit | $0 |

APY | Up to 5.46% |

Monthly Fees | $0 |

Promotions | None |

What Is Mercury ?

Mercury Technologies is a fintech company that works with partner banks to help small companies (startups) manage their cash flow better. It makes it easy for any company with formation documents and an Employer Identification Number (EIN) to open a business bank account.

Unlike many business bank accounts, the business accounts at Mercury are fee-free. Additionally, companies that keep more than $250k in their account can have their spare cash “invested” in extremely low-risk securities such as Treasury Bonds.

Account-holders can make payments using debit cards, wire transfers, ACH transfers, or payroll processing platforms. They can collect money from payment processors (Stripe, PayPal, etc.). The accounts are also designed to link to online accounting software.

What Does It Offer?

Mercury has several points of differentiation that set it apart from other business banking options. Here are four of its most notable features.

Streamlined Application Process

First, Mercury makes it super easy to apply for an account. Founders who have their articles of incorporation and your EIN number from the IRS will be able to complete an online application in minutes.

This simplified account opening is amazing. Many banks make the opening process difficult for small companies that are just trying to get started. Not so with Mercury.

Sure, you’ll need a few government documents to open up the account. But if you’ve taken care of those details, the bank account won’t take long to open.

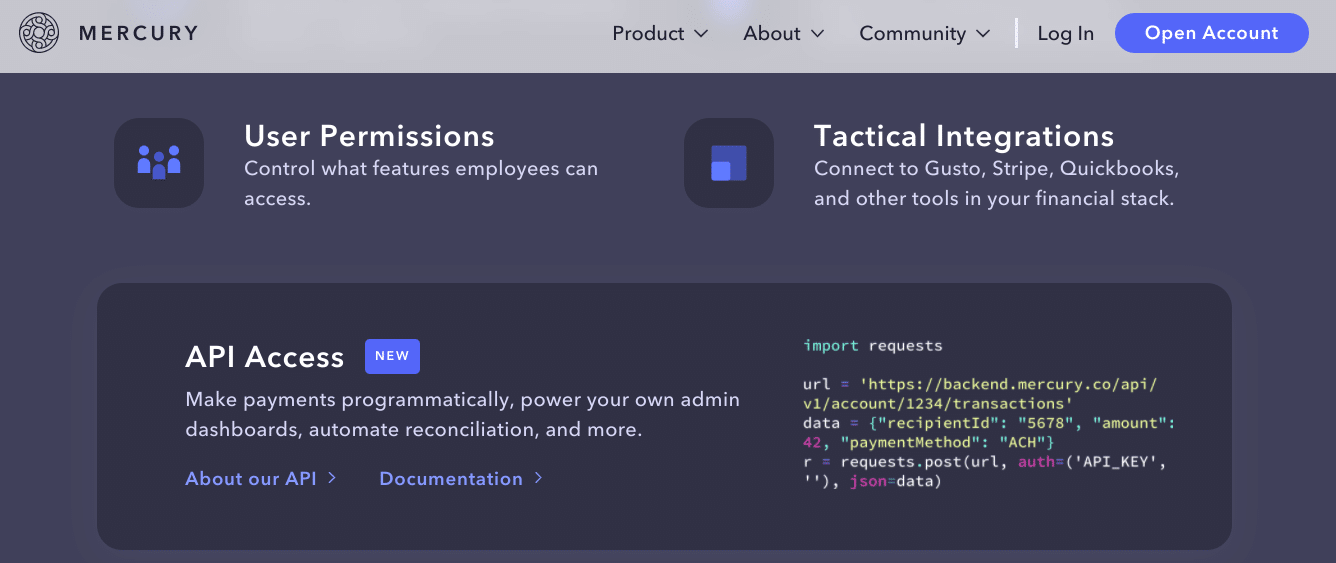

User Permissions

Mercury makes it easy for a founder to share financial responsibility among team members without turning over the keys to the bank account. It offers virtual cards and variable permissions for employees. Founders can also interact with their accounts via API which makes it easy for finance teams to develop reporting, or for developers to build integrations with apps and more.

Minimal Fees

The next point of differentiation is the low fees. Mercury only charges for wire transfer fees — $5 for domestic and $20 for international transfers. Everything else, including monthly fees and overdraft fees, are $0. Wire transfer fees are waived for "Tea Room" clients (those with at least $250k+ in deposits).

Tea Room Perks

In addition to the waived wire fees, Tea Room customers can also access "higher yields" through Mercury Treasury, which puts extra cash in U.S. Government securities and money market funds. Right now, you can earn up to 5.46% APY if you have over $20M in assets. See our favorite high-yield bank accounts >>>

If you have a Tea Room account, you'll also gain access to "Partner Perks" for things like bookkeeping, servers, and 409As. And, as its name suggests, Mercury will send you some free tea after you join Team Room and periodically thereafter.

You must have at least $250,000 in assets to be a part of the Tea Room.

Is Mercury A Bank?

On its home page, Mercury says that it offers "full-stack bank accounts." But, to be clear, Mercury isn't an actual bank. It's a fintech company that offers banking services through its partner banks, Choice Financial, Evolve Bank and Trust, and Patriot Bank.

Mercury doesn't have any local branches and it isn't able to accept cash deposits.

It should be noted that account holders can make fee-free cash withdrawals at all Allpoint network ATMs. Still, Mercury plainly says on its FAQ page that its product is geared towards tech startups and might not be the best fit for businesses that frequently deal with cash.

While users can keep their deposits at Mercury, it doesn’t typically serve as a lending institution. They do have partnerships for venture debt and more.

Header |  |  |  |

|---|---|---|---|

Rating | |||

APY | Up to 5.46% | 2.00% | Up to 4.50% |

Monthly Fees | $0 | $0 | $0 |

Min Deposit | $0 | $0 | $100 |

ATM Access | 55,000+ Free ATMs | 38,000+ Free ATMs | Unlimited |

Cash Deposits | |||

Cash Back | |||

FDIC Insured | |||

Cell |

Is It Worth It?

Mercury makes it easy to get started with low-cost business banking. With minimal fuss, you can quickly be up and running with a legitimate business bank account. This, along with Mercury's online tools and user permissions, could make it a compelling option for business owners.

However, you'll need to look elsewhere if you're wanting to earn a high yield on deposits, would like to get cash back on your debit card transactions, or need a bank account that can accept cash deposits. Compare your business bank account options here >>>

Mercury Features

Account Types | Checking and savings |

Minimum Deposit | $0 |

APY | Up to 5.46% |

Monthly Fees | $0 |

Overdraft Fee | $0 |

Wire Transfer Fee |

Waived for Tea Room accounts |

Cash Back | None |

Cash Deposits | No |

Tea Room Account Minimum | $250k |

Branches | None (online-only bank) |

ATM Availability | 55,000+ fee-free ATMs nationwide within the Allpoint ATM network |

Customer Service Options | Email only |

Customer Service Email | help@mercury.com |

Mobile App Availability | iOS |

Bill Pay | Yes |

FDIC Certificate | 1299 (Evolve Bank & Trust) |

Promotions | None |

Mercury Review

-

Fees and Charges

-

Products and Services

-

Customer Service

-

Ease of Use

-

Tools and Resources

Overall

Summary

Mercury Bank’s business bank accounts are low-cost, easy to open online, and integrate well with other business tools.

Pros

- No monthly fees

- Multiple employee permission levels

- Many third-party platform integrations

Cons

- Sole proprietors can’t open accounts

- Customers aren’t able to deposit cash

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Claire Tak