HSBC is one of the largest international banks, and it has a growing presence within the United States. They are mainly an online bank - and they offer some of the best yields you'll find on savings products. Plus, they also typically offer great bonuses for signing up for their accounts.

They are still a full-service bank, with a range of products. However, unlike other banks, they do lack branches in the U.S., and they don't have a huge ATM network.

Despite these set backs, should you consider HSBC? Here's what you need to know in our HSBC Online Banking Review. Also, see how they compare to the other best online banks.

Editor's Note: In May 2021, HSBC Bank announced that it will be exiting the domestic mass market retail banking business. Citizens Bank has agreed to purchase HSBC's East Coast mass market accounts while Cathay Bank will be buying its West Coast accounts. HSBC will continue to offer and service its Premier Checking and Premier Savings accounts, but all other deposit account customers will be transferred to new financial institutions in the near future.

HSBC Online Bank Details | |

|---|---|

Product Name | HSBC Premier Checking And Savings |

Min Deposit | $0 |

APY | Up to 0.40% |

Monthly Fees | $50/mo (Can Be waived) |

Promotions | $500 Bonus Offer On Premier Checking |

Who Is HSBC?

HSBC is an international bank with branches throughout the world. It is one of the largest banking and financial services organizations with a network covering 64 countries and territories. HSBC was founded in Hong Kong on March 6, 1865.

HSBC strongly emphasizes its international banking options for affluent customers. In fact, in May 2021 it announced that it would be focusing fully on these accounts and had agreed to sell its domestic mass market banking accounts to Citizens Bank and Cathay Bank.

What Do They Offer?

HSBC is a full-service bank offering personal and business financial products. Its products include checking, savings, mortgages, loans, credit cards, CDs, insurance, and retirement. In this article, we’ll look at personal deposit products.

Except for its Direct Savings account, HSBC products aren’t anything to write home about. However, if you are looking for a full-service, international bank, HSBC is a top choice.

Premier Checking And Premier Relationship Savings

After HSBC's domestic mass market retail customers have been transitioned to their new financial institutions, the only checking account it will offer is the HSBC Premier Checking.

There is a $75,000 minimum to waive the maintenance fee. It can also be removed with direct deposits of $10,000/month, or a $500,000 HSBC mortgage loan. Otherwise, the account incurs a $50/month fee.

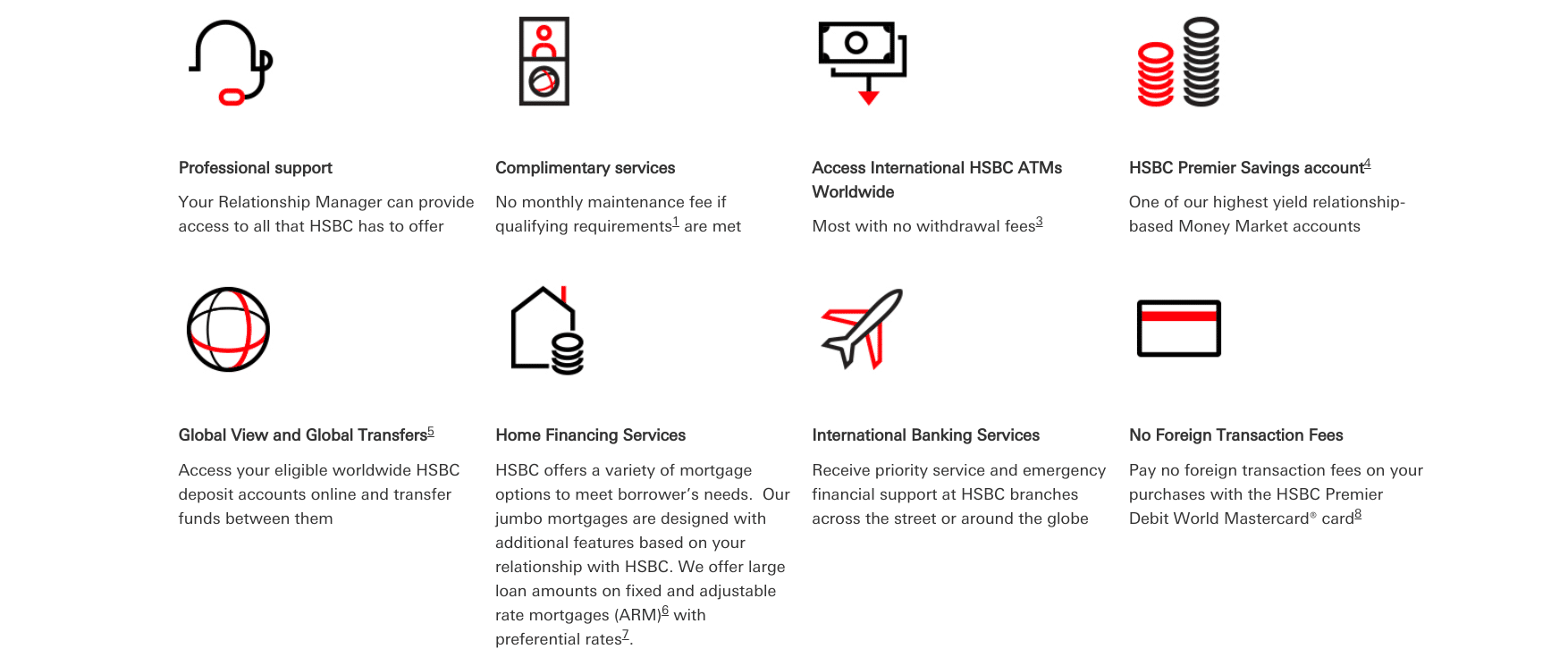

This is a great account for international banking. There are unlimited out-of-network ATM reimbursements, including at many international ATMs, and there are no foreign transaction fees.

Note that HSBC is currently offering a welcome bonus of $500 for new Premier Checking account customers. Learn the details about the bonus offer.

Another benefit of having a Premier Checking account is that it gives you the right to open a Premier Relationship Savings account. The standard APY for this account is 0.05%. But the "Relationship APY" is 0.40%.

One of the easiest ways to qualify for the higher APY is to spend $500 on your debit card per month. But you'll also earn the higher rate if you receive $5,000 in direct deposits, or have a $500,000 mortgage. Meeting any of these last three requirements will also cause your Premier Checking monthly fee to be waived so that's a big win-win!

Mass Market Checking Accounts

There are four mass market retail checking accounts to choose from on HSBC right now. For now, you can still open these accounts, but they will eventually be moved to Citizens Bank or Cathay Bank.

- Advance: You must maintain $5,000 in combined U.S. Dollar personal deposit accounts and investment balances OR a monthly recurring direct deposit from a third party to an HSBC Advance checking account OR an HSBC U.S. residential mortgage loan. Otherwise, the account incurs a $25/month fee. Four out-of-network ATM reimbursements are available in the U.S., except for New York.

- Choice Checking: There is no minimum with direct deposit or a requirement of $1,500 in other accounts. Otherwise, the account incurs a $15/month fee.

- Basic Banking: There is no minimum. The account will incur $1/month fee regardless of balance. The first eight checks are free, then after that they cost $0.35/check.

Mass Market Savings Accounts

Listed on the HSBC.com website are three mass market savings accounts. Their APYs range from 0.01% to 0.15%. Those rates aren’t enough to incentivize anyone to sign up, given the rates at 0.50% APY or above at many of the top online banks. Plus, these accounts will be moved to new banks in the near future

HSBC Direct

What you don’t see on the above site are two additional products. One is a $0/month fee checking account and the other is a 4.50% APY savings account. You’ll have to go to a completely different site to see both of them. There is no link from the hsbc.com website.

Why HSBC chooses to hide these products is a mystery. Below are the details on both products, which you can find at https://www.hsbcdirect.com. Note that as with the other mass market retail accounts covered above, HSBC has agreed on terms to sell these "Direct" accounts to new banks.

Direct Checking: There is no monthly fee and there are no fees when using HSBC ATMs within the U.S. It requires $1 to open. One drawback of this account is that you can’t write paper checks.

Direct Savings: This has a 4.50% APY. It requires $1 to open.

HSBC Direct products are online-only. Buy you can reach support 24/7 by live chat.

There is a mobile app available as well, which allows for mobile check deposits. HSBC has some branches on the east coast and west coast of the U.S. What this means for most Americans is that accessing a local branch or in-network ATM will be impractical.

Are There Any Fees?

There are maintenance fees on all non-Direct financial products. For Premier Checking and Premier Relationship savings, this monthly fee is $50. However, you avoid these fees by meeting minimum balance or activity requirements.

Other than the maintenance fees, you're unlikely to face any additional charges as a Premier HSBC customer. It doesn't charge overdraft or NSF fees. Wire transfers (both domestic and international) and ATM withdrawals are generally free as well and there are no foreign transaction keys.

How Does HSBC Compare?

The monthly maintenance fees (and minimum balance requirements to waive them) with the HSBC Premier Checking account are much higher than you'll pay with virtually any of our top online banks.

However, the international benefits that Premier Checking offers, such as access to a worldwide ATM network and no foreign transaction fees, are nice. And the Relationship APY that HSBC offers on its Premier Savings account is solid if you meet the requirements to receive it.

The bottom line is that HSBC is one of the best international banking options available today. But if you only need domestic banking support, you have better options. Here's a quick look at how HSBC Bank compares:

Header |  |  | |

|---|---|---|---|

Rating | |||

Top APY | 4.50% | 2.00% | 4.25% |

Monthly Fees | $50 (can be waived) | $0 | $0 |

Min Deposit | $0 | $0 | $0 |

Branch Access | Yes, in 64 countries | No | No |

Foreign Transaction Fee | No | No | Yes, up to 1% |

FDIC Insured | |||

Cell |

How Do I Open An Account?

To open a regular HSBC checking, savings, or CD product, visit the HSBC website and select the product you want to open. To open an HSBC Direct Checking or Savings account, visit https://www.hsbcdirect.com.

To open an account, you must be 18 years old, have a Social Security number, and valid U.S. ID. You’ll need to have a U.S. residential address for the past three years as well.

Is My Money Safe?

Yes — for U.S. deposit account holders, funds are backed by the FDIC. HSBC also uses bank-grade encryption on its website.

How Do I Contact HSBC?

HSBC has a physical presence in 64 difference countries. However, if you live in the United States, you may have a hard time finding a local branch near you. After the bank completes its impending exit of 90 U.S. branches, it will only have 58 remaining.

Of course, that's still 58 more branches than online-only banks offer. And HSBC does offer 24/7 phone support for Premier customers at 888-662-4722 in addition to a variety of live chat options. Finally, you can Tweet HSBC's customer care team @HSBC_US from 7 AM - 7 PM (ET) Monday-Friday and 8:30 AM - 5 PM (ET) on Saturday.

Is It Worth It?

If you're looking for a full-service bank within the U.S., HSBC probably isn't going to be your top choice. The lack of branches and in-network ATMs across the country is a big disadvantage compared to other major U.S. banks. The high balance requirements to avoid monthly fees also aren't competitive. However, if you need an international, full-service bank, HSBC has a strong standing throughout the world.

HSBC Bank FAQs

Let's answer a few of the questions that people often ask about HSBC Bank:

Is HSBC leaving the U.S.?

Not completely, but it is shuttering its mass market retail banking operations. After its exit, HSBC will focus on meeting the international banking and wealth management needs of higher net worth clients.

Are HSBC bank accounts still open to anyone?

For now, yes. But eventually all non-premier checking, savings, or credit card account will be moved to new financial institutions.

What does HSBC stand for?

The letters in HSBC's acronym stands for Hongkong and Shanghai Banking Corporation Limited.

Does HSBC have any bonus offers?

Yes, through February 15, 2023, new Premier Checking customers who complete qualifying activities will receive a welcome bonus of $500.

HSBC Bank Features

Account Types |

|

Minimum Deposit | $0 |

APY | Up to 0.40% |

Maintenance Fee | $50 (for Premier Checking) |

Requirements To Waive Monthly Fee | Premier Checking: $50

Premier Savings: $50

|

Remote Check Deposits | Yes |

Foreign Transaction Fee | No |

Branches | Currently 148 but will soon be 58 |

ATM Availability | Fee-free withdrawals and deposits at in-network ATMs listed here. |

Customer Service Number | 888-662-4722 |

Customer Service Hours | 24/7 availability |

Mobile App Availability | iOS and Android |

Bill Pay | Yes |

FDIC Certificate | |

Promotions | $500 bonus offer on Premier Checking |

HSBC Online Banking Review

-

Interest Rates

-

Fees and Charges

-

Customer Service

-

Ease of Use

-

Tools and Resources

-

Products and Services

Overall

Summary

HSBC is a full-service bank that has a huge international presence.

Pros

- Solid Premier Relationship Savings APY

- Great bonus offer for Premier Checking

- Robust international banking services

- No foreign transaction fees

Cons

- Not known for strong customer service

- HSBC will soon be shutting down its U.S. mass market retail banking business

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Chris Muller