When you purchase rental real estate, there’s often a steep learning curve. You have to understand the market, figure out how to finance a property purchase, and learn to screen tenants. You’ve likely heard horror stories involving unpaid rent, broken toilets, or issues with HOAs.

Even the basics of real estate investing can be tricky to master. Everything from paying quarterly taxes to separating your business and personal finances is new to many real estate investors.

If you don’t have a plan to streamline your business, your bookkeeping can turn out to be an even bigger nightmare than a leaky toilet or delinquent tenants.

In this post, we explain:

- What to look for in a bank for your real estate investments

- The best banks for your investments

- Why getting your business banking setup is so important

My Experience As A Property Owner

As a real estate investor, I’ve made just about every mistake in the book when it comes to selecting a primary institution for my real estate business.

I mixed up business and personal finances. I picked banks that don’t allow for mobile or cash deposits. More than once, I chose banks that closed down after a year or two, which meant I had to set up all my accounts again with another bank.

What To Look For In A Real Estate Bank

- No monthly maintenance fees. Business bank accounts often carry fees of $15 to $20 per month or more. But there’s really no reason to pay these fees unless you’re doing a large volume of business. In general, you can find free checking accounts that will suit your real estate needs.

- Multiple ways to accept money. You may plan to collect money via online collections, but you never really know how your tenants will actually pay you. I’ve received cash, money orders, and personal checks even though my lease clearly states that I only accept online payments. At the end of the day, I don’t turn away tenant money. Find a bank that allows you to deposit cash and checks so that you can get the money in the right place.

- Integration with other bookkeeping and management tools. If you use bookkeeping software or other rental property management software, you will want your software to connect to the bank account. Two of the banks we recommend below are built as integrations with end-to-end rental property management tools. The other banks aren’t specifically integrated with management tools, but they connect to bookkeeping and other management software.

- No transaction limits. Some business accounts charge fees if you have more than 20, 40, 50, or 100 transactions in a month. While rental properties don’t typically require lots of payments, these limits seem unnecessarily frustrating to work around.

- Be wary of newer institutions that may close down after a few years. Newer online banks or FinTechs often offer great incentives like high yields, account opening bonuses, and more. But they might not succeed in the long run. If your bank shuts down, you might not get access to the funds in your account for weeks or even months. On top of that, you’ll have to set up a new account with new payments. It’s a huge pain, so be aware of this when searching and go with a more established institution if this matters to you.

The Best Business Savings Accounts

On the hunt for a savings account too? We compare the best business savings accounts for your business needs.

'Overrated' Banking Features

While the features above are critical for real estate investors, there are a few features that new real estate investors may overvalue. These are a few to think about:

- Access to loan products. In general, real estate investors use financing to buy property. However, your primary real estate bank doesn’t need to be known for its loans to real estate investors. If you buy single-family homes or small multi-family homes, a mortgage broker is more important than a banker. They can help you shop for mortgages at a range of banks depending on your needs at the time. Mortgage brokers can also assist with establishing home equity lines of credit or refinancing houses to cash out equity to buy new investments.

- High-yield checking accounts. Right now, you can earn incredible yields when you put cash in high-yield checking or savings accounts. But the cash you earn from real estate is often going to be reinvested in a future property purchase or used to pay down a mortgage. If you can find a high yield, that’s great. But it’s not the end of the world if you have to transfer money to a higher yielding account once a quarter.

The 5 Best Banks For Real Estate Investors

Based on the criteria set above, these are our top five banks for real estate investors.

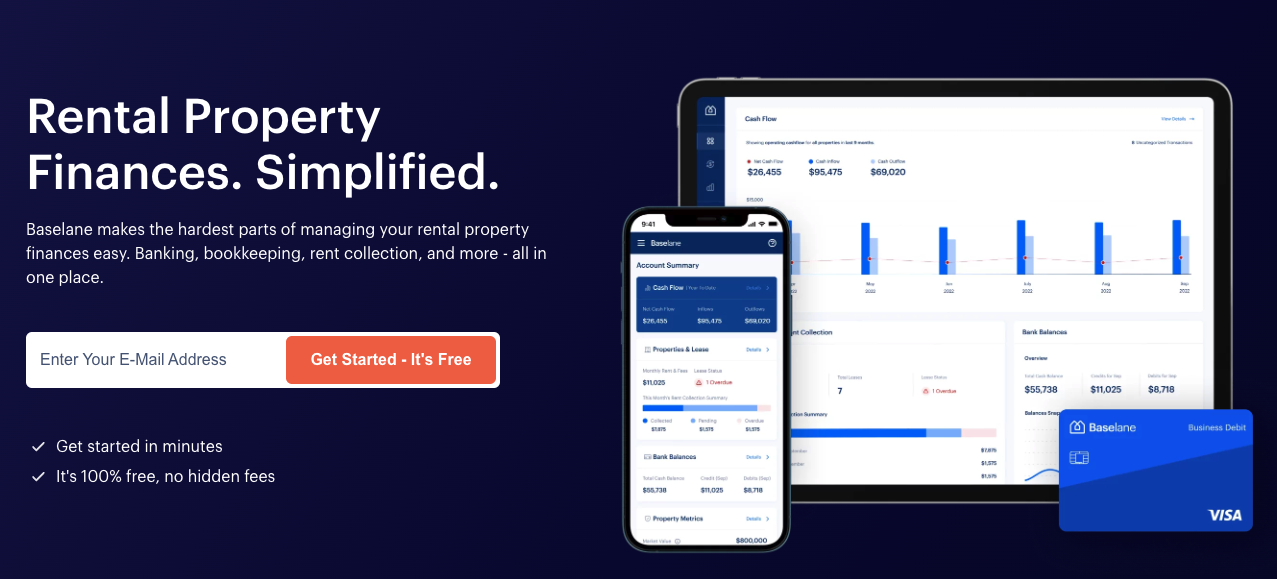

1. Baselane

Baselane is an integrated management and banking solution for landlords. Founded in 2020, the company offers free business checking for landlords. The Baselane system includes beautiful reports, high account yields, and access to loans and insurance products designed for landlords.

Account highlights:

- Fully integrated with tenant screening and rent collection systems

- Accepts mobile check deposits

- Accepts cash deposits at Allpoint ATMs

- 4.19% APY

- 1% cash back on all debit purchases + Up to 5% cash back on the first $2,000 of spending

- No transaction limits

- Real estate loans are available

- Real estate insurance is available

Account risks:

- Only established in 2020

- Clunky to switch to Baselane if you’re using an alternative rent collection system

Bonus: Right now Baselane is offering a $300 bonus for new accounts!

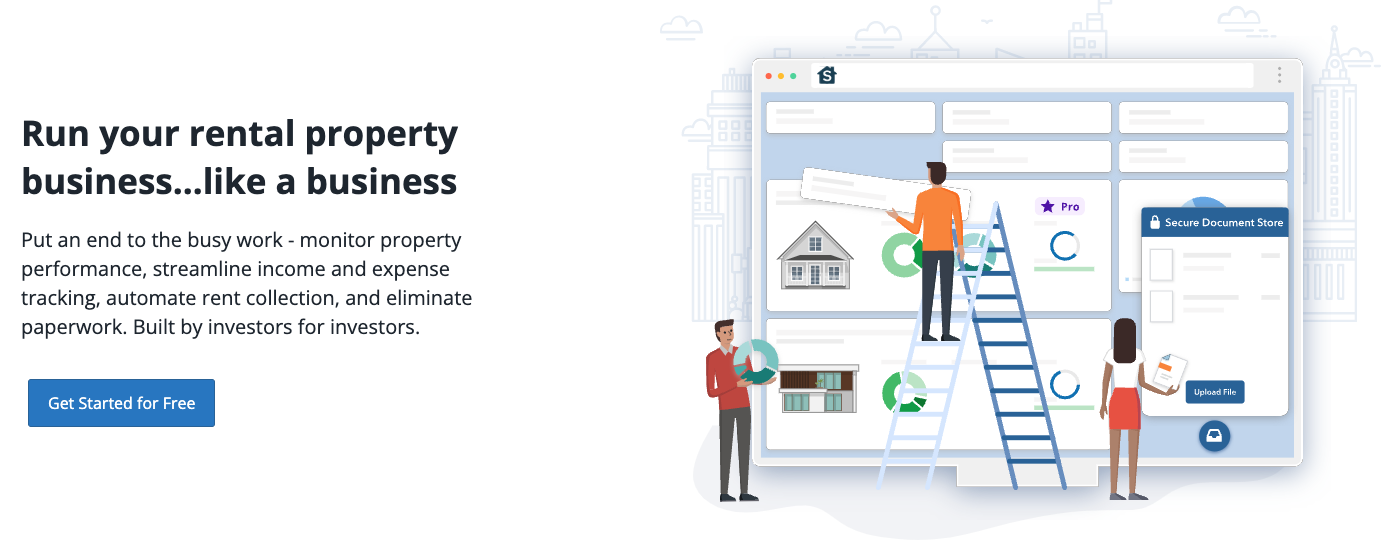

2. Stessa

Stessa is a recent outgrowth of Roofstock, an established turnkey real estate company. Stessa was founded in 2016 but was more recently acquired by Roofstock. The company has both free and paid solutions for landlords to consider.

Account highlights:

- Free integration with property management software

- Some free reporting

- Earn up to 5.06% APY

- Mobile check deposits

- Receive Schedule E with a paid subscription to Stessa Pro

Account risks:

- No ability to deposit cash into accounts

- Stessa Pro costs $20 monthly or $192 annually

3. Axos Bank

Axos Bank is a digital-first bank that provides free business checking for a range of businesses. On top of being a great place for your business checking account, Axos is a full-service bank that offers high-yield savings, CDs, and more.

Account highlights:

- Up to $400 for opening a new account

- Accepts mobile check deposits

- Accepts cash deposits at Allpoint ATMs

- Reimburses up to 2 domestic wires per month

- Accepts a range of business types

- Access to a full-service business bank

Account risks:

- Need to set up outside bookkeeping tools

- You will not earn interest when you use Business Basic Checking

- No more than 60 remote deposits each month

- $5,000 minimum daily balance to waive the monthly fee for Business Interest Checking

4. First Internet Bank

Founded in 1999, First Internet Bank is a pioneer in digital banking, but it continues to push the envelope to serve its customers. Its award-winning Do More Business Checking account has no minimums and no monthly fees.

The account is ideal for landlords seeking an established bank to set up their finances.

Account highlights:

- No monthly minimums or fees

- No transaction limits

- Earn 0.5% APY

- Mobile check deposits

- Cash deposits at ATMs

- Reimbursement for up to $10 in ATM fees

- Access to high-yield savings and other banking products

Account risks:

- Cash deposited at ATMs is not immediately available

5. Digital Federal Credit Union

Digital Federal Credit Union (DCU) has robust free checking options for member business owners. To join DCU, you must join a member organization or be eligible through an employer or community sponsor.

Fees to join the member organization start as low as $10. Despite including the word Digital, DCU has branches in the Northeast as well as mobile banking options.

Account highlights:

- No monthly minimums or fees

- Up to 20 transactions per day

- Mobile check deposits

- Cash deposits at ATMs

- Access to more than 80,000 ATMs

- Reimbursement for up to $10 in ATM fees

- Access to high-yield savings and other banking products

Account risks:

- Earn just 0.1% APY

- Must be eligible to become a member at DCU

- Pay $.10 per deposit if you deposit more than 20 items in a day

Set Up A Separate Real Estate Bank

Every business checking account has advantages and disadvantages and none of the accounts listed is perfect. What’s more important is getting your finances separated as quickly as possible.

Bookkeeping becomes simple when you keep your real estate finances out of your personal finances. And if you’re struggling to turn a profit with your rental properties, you want to know how much you’re losing each month.

Do yourself a favor and start a real estate checking account before you start investing in real estate or as soon as possible. Just like your personal banking, be sure to go with the one that makes the most sense with your preferences and business needs.

Hannah is a wife, mom, and described personal finance geek. She excels with spreadsheets (and puns)! She regularly explores in-depth financial topics and enjoys looking at the latest tools and trends with money.

Editor: Claire Tak Reviewed by: Robert Farrington