Passive income is unearned income typically derived from investments. That’s pretty simple, so there has to be more to it, right?

Let’s dive in and explore what passive income is, if passive income is actually real, the different types of passive income, and more.

We’ll even get into some of the technical aspects of passive income—taxes and real world examples.

Ready to learn about passive income? Let’s dive in.

What Is Passive Income

As we said earlier, in the broadest sense, passive income is unearned income. Basically, you have income you work for (at a job, business, side hustle), and you have income that you don’t work for—passive income.

Passive income is always derived from an investment.

There are two ways to create passive income, you can invest your time or your money. Most passive income opportunities require a combination of both.

For example, you can invest your time in creating a song or photograph, which you can sell and earn royalties on.

Or, if you have money, you can buy a stock or real estate and receive income from it.

In a combination approach, you can buy a fixer-upper property, invest your time fixing it up, and then rent it out to receive higher passive income. If you were doing this project to flip the property; I’d actually argue that’s not passive income. But if you’re boosting your rent through sweat equity, that’s passive income.

What Passive Income Is Not

The key thing to remember is what passive income is not. Passive income is not income derived directly from work such as:

- Your day job (employment)

- Freelancing

- Owning a small business

These examples above are active income.

Is Passive Income Real?

It doesn’t sound like passive income is truly passive, does it? It makes you wonder if passive income is real.

Passive income is real but you have to do something upfront to realize the income later. That something either involves your time or money.

The goal is to do work or use your money at one point and enjoy the rewards of that passively (i.e. by not having to do more work or invest more money) over time.

Different Types Of Passive Income

Now that we understand some of the basics of passive income, what are the different types of passive income?

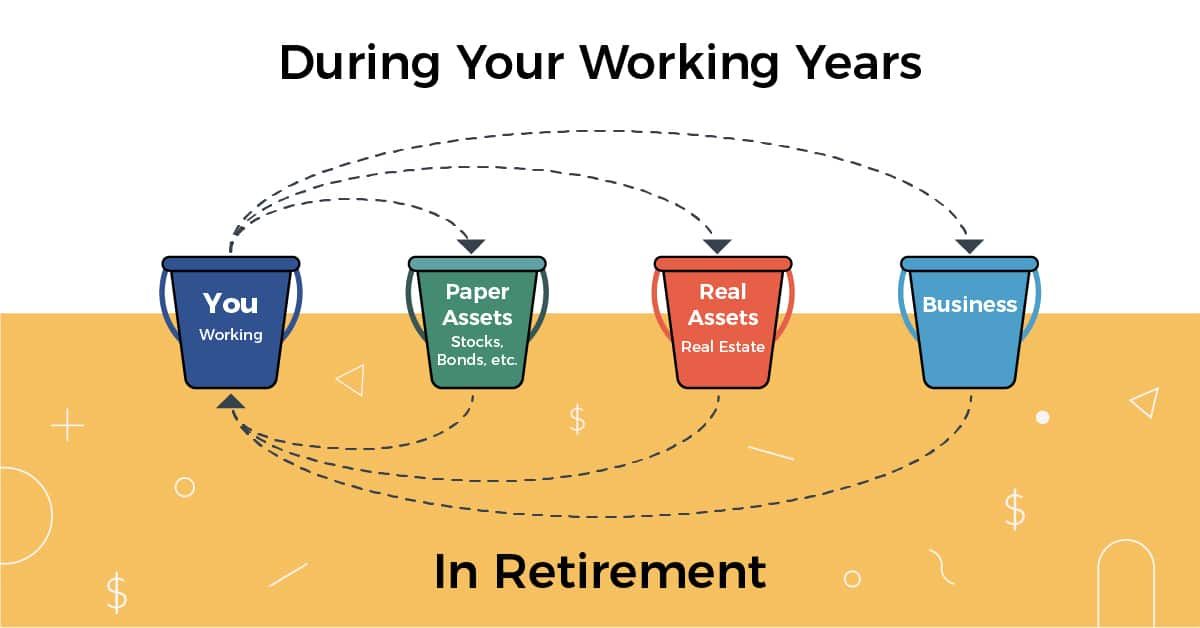

I like to think of it using our buckets of assets approach:

- You (active income)

- Paper Assets (typically passive income)

- Real Estate assets (could be active or passive income)

- Business Assets (could be active or passive income)

Let’s start with paper assets as these are the types of passive income most people would be familiar with: stocks, bonds, mutual funds, savings accounts, and more.

These are investments that require an upfront monetary investment, but you can earn passive income from owning them. No future work is really required (except checking your accounts).

Real estate assets could be active or passive. For example, if you invest in a REIT, you don’t do anything except enjoy the passive income provided. However, if you own your own duplex, it could be a combination of active and passive income.

Business assets are similar. If you’re working in your business, it’s not passive. But if you’re simply an investor in another business, that could be passive.

Pros And Cons Of Passive Income

While passive income is typically viewed as a positive, there are pros and cons.

Pros

- You can earn income without any work!

- You can gain extra cash flow

- More financial freedom, including early retirement

Cons

- Some forms of passive income may be less-liquid, meaning you can easily access your principal (it’s locked up)

- Depending on what you invest in, your return may not be great

- Using your time (rather than money) is unpredictable

Why Everyone Should Build Passive Income Streams

At the end of the day, everyone should be building passive income to create multiple income streams.

Why? The best person to take care of your finances is you.

You don’t want to be dependent on an employer or a pension fund for your income. You want to be able to control your own financial destiny, and you do that by investing and building wealth, which in turn will generate passive income for you to live off of.

Plus, at some point, you won’t be able to work (either retirement or even something unexpected like an accident). You want to be able to provide for your family with an income stream, even if you can’t go to a day job to earn it.

How Much Can You Earn?

So, how much can you earn? It depends. The key factor that it depends on is money. When it comes to using your time, a little luck is involved (like having a song go viral that you can earn royalties on).

For a basic calculation, let’s talk about passive income from a savings account. You can earn interest on your savings. The best accounts pay 4% in interest per year right now. That means you can earn $400 for every $10,000 you have saved. And that’s truly passive income.

A cool feature about passive income is that it usually also sees compound growth. What that means is that in the future, you earn income on your past interest.

Going back to our savings account example, in year two, assuming you didn’t add any money, you’d now have $10,400. And earning 4% on that is $416. So you earned $16 more than the prior year.

This is powerful. Remember our example from “would you rather have a penny that doubled each day or $1,000,000?” The penny that doubles is way more valuable!

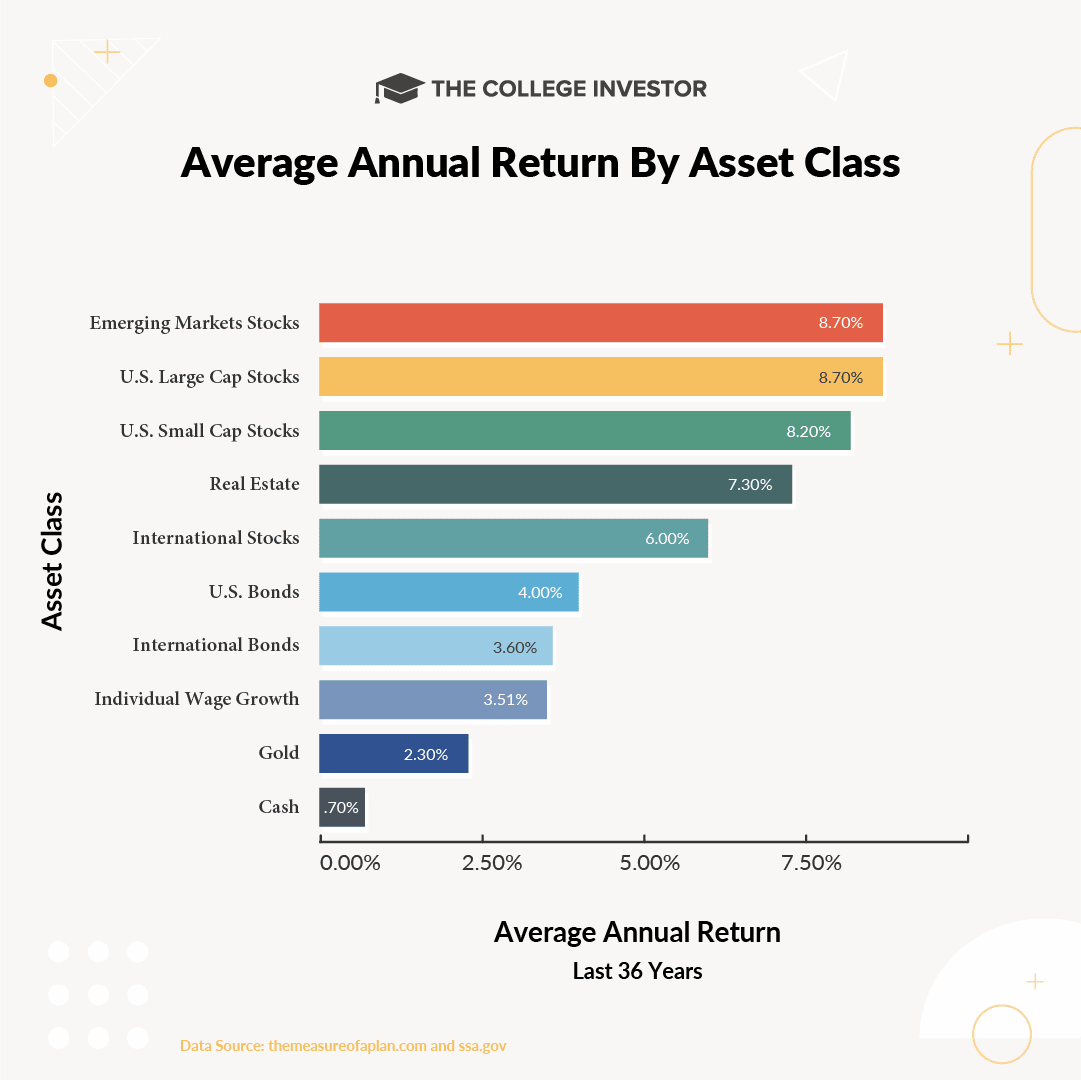

And what if you invest instead of just saved? You can earn a lot more (and see your money grow a lot more). See this chart to the average return by asset class:

Is Passive Income Taxable?

What about taxes? Everyone likes to talk about taxes when it comes to money. And there are really bad takes out there—like you shouldn’t earn more because you pay more in taxes! Don’t listen to that bad advice.

Yes, the money you earn as passive income is potentially taxable. But that’s not a bad thing—you’re earning more money!

I’d rather earn an extra $100 knowing I only keep $80, than not doing anything at all and not having that $80.

Passive income is taxed based on what type of income it is:

- Interest and dividend income is typically taxed based on these capital gains rates

- Capital gains are taxed as capital gains (such as from mutual funds)

- Real estate income and business income are typically taxed at your ordinary income tax rate

- Collectibles get a special tax rate if you’re involved in those

If you’re confused on whether your passive income is taxable, speak to a tax professional!

Most Popular Passive Income Examples

We have a full guide to the most popular passive income ideas here >>

Here’s a little sampling of these ideas:

Savings Account

Right now, you can earn upwards of 4% in a savings account, and even more in a Certificate of Deposit.

Stocks

Stocks pay dividends, and you can get started investing in stocks for as little as $10 at most major brokerage firms. Plus, it’s commission-free to invest in stocks, mutual funds, and ETFs and most places.

Real Estate

There are a lot of ways to invest in real estate, but from a passive investment perspective, a REIT or a fund is the best.

Final Thoughts

Passive income may seem like a myth, but it’s real and anyone can build it. The key is to start early, even if you’re starting very small. Your investments will grow over time, generating more passive income for you, which in turn will grow more.

So, even if you only have $10, get started with passive income!

Passive Income FAQ

Let's break down some common passive income questions!

What is passive income?

Passive income is unearned income typically derived from investments.

What is an example of passive income?

The most common example of passive income is a savings account. You simply deposit your money into the account, and your earn interest for doing no work. That interest would be considered passive income.

Can you live off passive income?

Yes! In fact, this is the goal of retirement. You have enough saved and invested that you generate enough income to live off of.

What are three forms of passive income?

There are various forms of passive income - which either require an upfront monetary investment or upfront time investment. You can save money, invest money, or invest your time to create something that you can sell in the future passively.

How can you start building passive income?

You can commit your time or money (or both). If you have a little extra money in your budget, start saving and investing it. If you have a little extra time, start side hustling to create something that you can sell to earn money.

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Claire Tak