Credit Karma is one of our favorite tools for monitoring your credit score and financial health.

Your credit score is one of the key indicators of your financial health. If you aren’t staying on top of your credit, you could be paying too much interest on your loans or overpaying for insurance.

Thankfully, with Credit Karma you can get free credit scores, free credit reports and more.

Here’s what you need to know about Credit Karma. Check out Credit Karma here >>

Quick Summary

- Free credit score monitoring and tools

- Loan marketplace to help you save on future loans

- Scenario planning to help you boost your score

Credit Karma Details | |

|---|---|

Product Name | Credit Karma |

Price | Free |

Offers | Credit Monitoring, Banking |

APY | 4.10% APY |

Promotions | None |

What Is Credit Karma?

Credit Karma was founded in 2007 by Kenneth Lin, Ryan Graciano, and Nichole Mustard. The original goal was to provide free credit scores and credit reports to consumers nationwide, as well as to help consumers navigate the complex world of credit.

Over time, Credit Karma added a robust suite of features including a loan marketplace, banking, and more.

In 2020, Credit Karma was bought by Intuit (the maker of TurboTax and Quickbooks), and it was forced to spin-off its tax software product (which has since rebranded as CashApp Taxes).

Credit Karma is still a fantastic tool to monitor your credit, and we named it one of the best credit monitoring apps for 2023.

Credit Karma Features

Credit Karma started out as an online credit monitoring site, but it offers much more than just credit score monitoring. This is a list of a few of the resources users can access for free at Credit Karma.

Free Credit Scoring

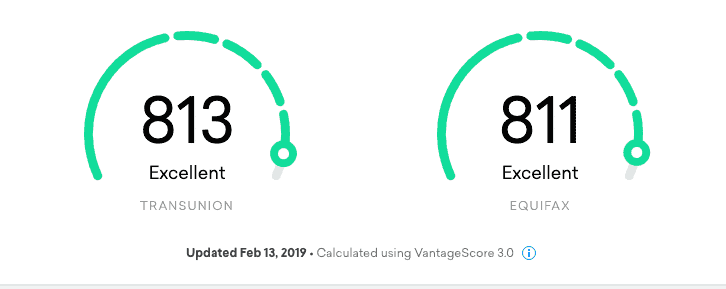

Free credit monitoring is Credit Karma’s flagship feature. It offers free snapshots of your Vantage 3.0 credit score. Users can also access their entire credit report from Transunion and Equifax.

The credit reports are laid out so that you can dig into the credit score factors (such as hard credit inquiries, accounts in collections, payment history, etc.

If you’ve ever struggled with your credit score, Credit Karma makes it very easy to figure out what you need to do to fix your credit.

Credit Score Simulation Tools

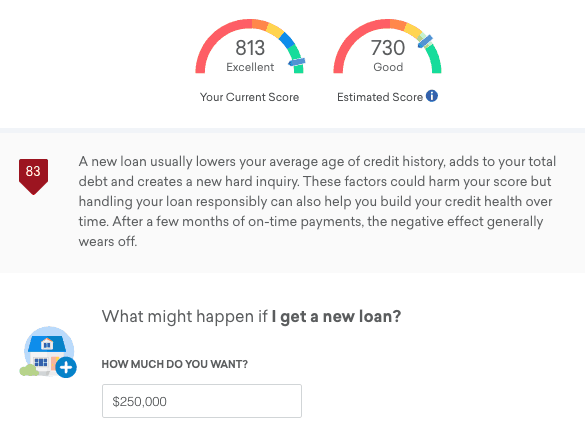

In addition to showing your credit score, Credit Karma has a credit score simulation tool. The tool helps you consider “what if” scenarios. For example, what will happen to my credit score if I take out a $250,000 mortgage. In my case, the answer is that my credit score falls to 730.

However, Credit Karma explains that the negative effect of the new loan wears off over time. You can also use this tool to see how your credit score will fare if you start to carry a balance on your credit card. For example, if you use a 0% credit card to pay $3000 for roof repairs, what will happen to your credit score?

Loan Marketplace

The primary way that Credit Karma makes money is by referring people to lenders. Using Credit Karma’s loan marketplace, you can compare credit cards, personal loans, auto loans and more. If you start an application for a loan from Credit Karma’s marketplace, Credit Karma will earn a commission.

Overall, the Credit Card marketplace had some good cards, but people who travel hack will be disappointed by the overall collection. If you’re simply looking for a good card with a low interest rate or decent cash back potential, Credit Karma will help you find the right card.

Home Buying Information

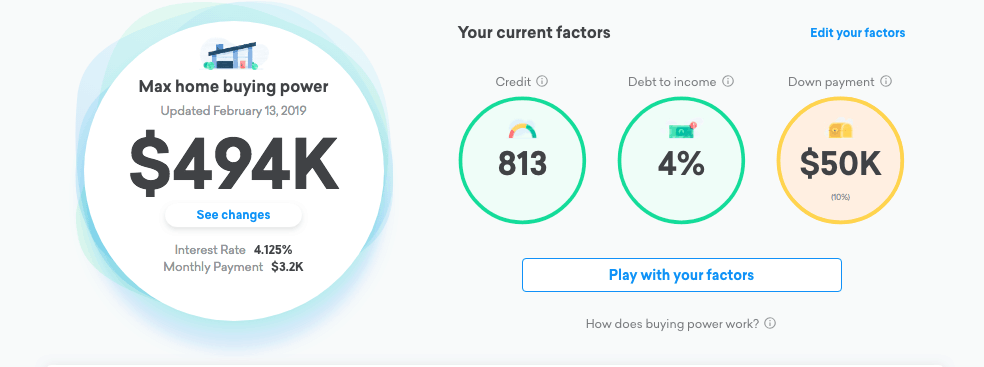

One of Credit Karma’s newest features is a home buying section. Credit Karma allows users to input their income and savings to generate a “home buying power” estimator. This shows the MAXIMUM amount you’re likely to be approved for if you take out a mortgage.

While it’s helpful to see this, it’s important to note that you should set your own budget when shopping for a home. In our case, Credit Karma estimates that we could carry a $3200 monthly mortgage payment. However, when I consider my childcare costs and the fact that we pay for our health insurance, the $3200 is outrageously high.

Although the estimates may be too generous, Credit Karma’s home buying center is still useful. Users can explore interest rates on mortgages, and even apply for loan pre-approval from one of Credit Karma’s partners.

High Yield Savings

Credit Karma recently released Credit Karma Savings - a high yield savings account that has no minimums or fees, and a top notch yield.

Right now, Credit Karma Savings is offering 4.10% APY. That puts it near the top of rates of our best places to open a savings account.

The account has no fees, no monthly minimums, and is FDIC insured up to $5 million through a network of partner banks. The only drawback is that this is a real savings account, which means withdrawals are limited to 6 times per month.

Tax Software

Credit Karma used to offer tax software, but since it was acquired by Intuit (the maker of TurboTax), it sold its tax preparation company. That company was rebranded as Cash App Taxes (you can read the Cash App Taxes review here).

However, Credit Karma is the partner for TurboTax for their tax refund advance loan this year. You must get your TurboTax loan sent to a Credit Karma money account.

Is Credit Karma Really Free?

Credit Karma is really 100% free to use. However, Credit Karma uses its platform to refer people to lenders. It earns a commission when users apply for a loan from the site.

It’s important to remember that Credit Karma uses financial health as a way of marketing financial products. If you’re struggling financially, you probably should not apply for new credit cards until you can consistently earn more than you spend.

Will Credit Karma Keep My Information Safe?

When you join Credit Karma, you provide your social security number, and all your credit information. Whenever you enter that information to a website, you increase the likelihood that you’ll become a victim of identity theft.

Unfortunately, if you plan to operate within the framework of the modern financial system, you’re at risk of digital identity theft anyhow. Nobody can keep their information 100% safe. That said, Credit Karma uses bank level security including 128-bit information encryption and read only access to your information.

The real concern for most people is not whether their data is safe, but how Credit Karma will use their information. Credit Karma doesn’t sell information, but they use your financial data to recommend products and services to you. And they've recently gotten into issues with the FTC around this practice.

When users apply for a loan from the platform, Credit Karma passes the information to the bank.

CreditKarma will not sell your private information, but they will use it. They use your information to recommend products and services that might interest you. If you choose to apply for a loan or a credit card CreditKarma will pass your information to the bank.

Should I Use Credit Karma To Track My Credit?

Credit Karma is my favorite tool for tracking my credit score. It’s got a great user interface, and the interface is loaded with extras that make getting your credit score in shape easy.

While there are tons of other credit scoring tools, Credit Karma is still my top recommendation if you’re not getting a free score somewhere else.

Credit Karma Review

-

Commissions and Fees

-

Ease Of Use

-

Customer Service

-

Products and Services

Overall

Summary

Credit Karma is our favorite free tool for checking your credit score and monitoring your credit.

Pros

- A free tool to understand your credit and financial health

- Uses your Vanguard score to approximate your credit score

- Lots to tools to help improve your credit

Cons

- The platform is advertising-driven, and your information is used to target offers for you

- It’s not your FICO score

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Claire Tak