Cleo is a financial assistant that offers two main services: the first is a text based/natural language interaction with your money and accounts. This can be text based budgeting, spending tracking, recommendations, and more.

Second, Cleo offers a paid service that offers overdraft protection and spending rewards.

Depending on your money habits and needs, these can be compelling offers. Find out more in our Cleo review below.

Meet Cleo Details | |

|---|---|

Product Name | Cleo Plus |

Price | $5.99/mo |

Platform | iOS and Android |

Features | Overdraft Protection, Rewards |

Promotions | None |

What Is Cleo?

Cleo is an AI-driven app that helps you track your spending, save money, and achieve your goals. The AI chatbot makes it easy to use Cleo's budgeting tools to help you understand how much you can spend before your next paycheck (i.e., takeout).

The company behind Cleo is Cleo AI Ltd. Cleo was founded in 2016 by Barnaby Hussey-Yeo and was initially focused on EU users then later expanded to the U.S.

“We serve 20 to 30-year-olds, and 60 percent of them have overdrafts and they use credit cards. There’s nothing out there that helps them make better decisions in the long term, nothing that guides them through this sort of stuff,” Hussey-Yeo told the Center for Data Innovation in an interview.

In a comment to Forbes, he explained, “Traditional financial products, such as overdraft fees or credit cards, don’t work for millennials. This generation expects intuitive and supportive technology that speaks its language without complexity or condescension.”

What Do They Offer?

Cleo offers two products. One is free and lets users type in natural language text to get information about their finances. There is also a fee-based subscription service that provides overdraft protection and spending rewards.

Cleo can be accessed through Facebook Messenger, iOS, and Android. The Cleo app has a 4.6/5 rating on the Apple App Store out of over 70,000 ratings. Cleo has nearly 4 million users worldwide.

Cleo’s Free Service

With Cleo’s free subscription you can:

- Set up a budget

- Autosave

- Track your money

- Get speedy support (replies take 6 minutes on average)

The free service lets you query financial transactions by typing commands and questions to Cleo through the Cleo app. Some commands and questions include:

- Am I overpaying for energy?

- What’s my average food spend?

- How long until payday?

- What is my salary?

- What’s my biggest expense?

- What’s my budget?

- How much have I spent on Ubers this month?

- Show me graphs!

- Show my upcoming bills.

Cleo Plus

Cleo Plus is a subscription which gives you access to more financially useful features which, over time, helps build your credit history.

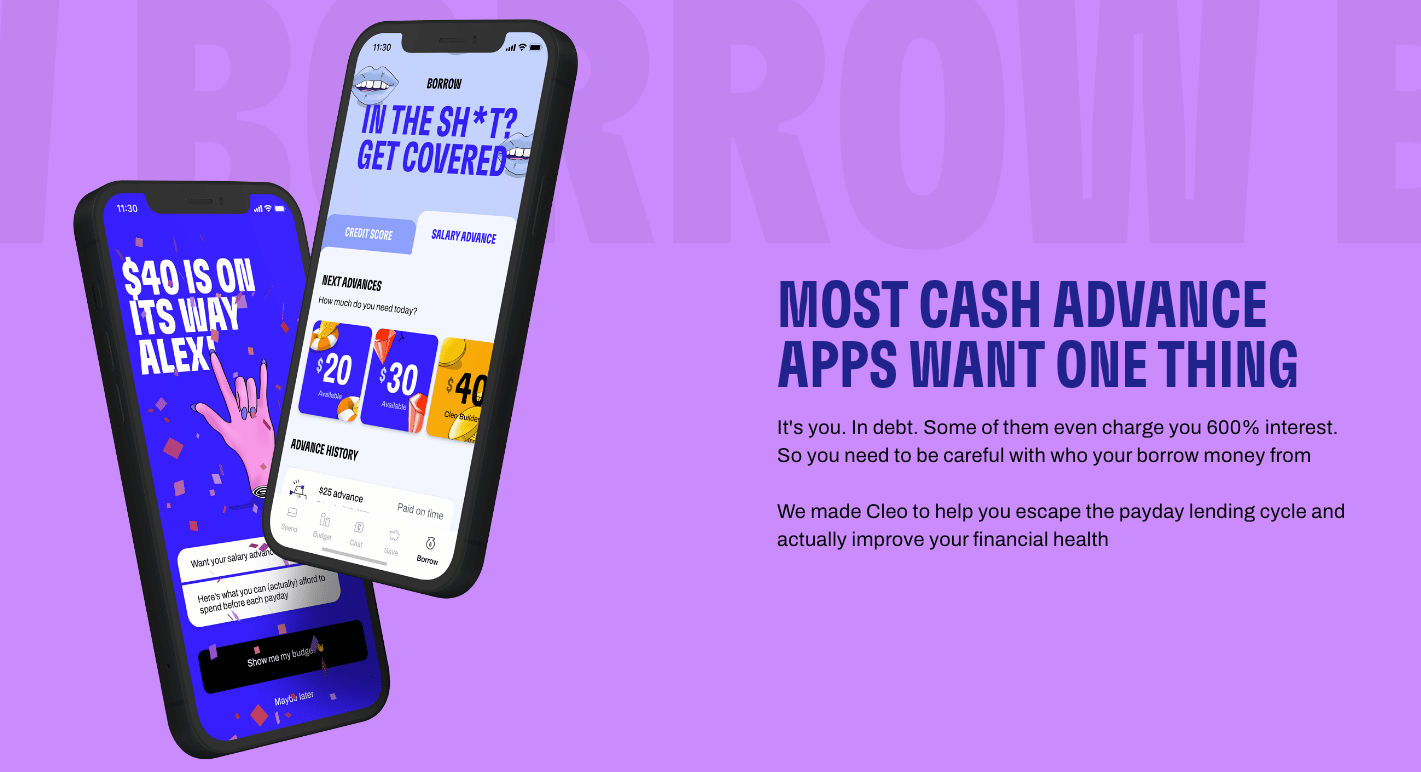

With the Cleo Plus cash advance feature, you can access some cash —up to $100 if you qualify. First-time users usually get between $20 to $70.

Cleo says this feature is intended to help you get cash instead of spending what you don't have and incurring overdraft fees. This feature is interest-free and doesn't come with credit checks so it won't affect your credit score.

It costs $5.99/month and includes everything the free subscription offers, plus the following:

- Access to your credit scoring

- Personalized saving goals and round ups

- Cash back at some of your favorite stores

- Up to $100 cash advance (if you’re eligible)

Are There Any Fees?

If you only want to query your financial transactions, there’s no fee.

If you want to use Cleo Plus, there is a $5.99/month fee.

How Do I Open an Account?

You can sign up at https://www.meetcleo.com.

Is My Money Safe?

Yes — Cleo uses bank-grade encryption. The app connects to your bank using Plaid. Plaid is a trusted source and used by popular financial companies such as Venmo, Betterment, Coinbase, American Express, Acorns, and Fannie Mae.

After signing up, you’ll link your bank account to Cleo. Cleo will analyze your transactions. Don’t worry, Cleo has read-only access. It can not move money around or make any changes to your accounts.

Cleo has also set up an insurance policy to further protect its customers. In an interview with badcredit.org, Cleo’s Content and Communications Manager El Winter said, “We also have a $250,000 insurance policy so in the event that there are any security slip-ups, you are completely insured.”

While Cleo runs through Facebook Messenger, Facebook does not have access to your banking information.

In the event that your Facebook account is hacked, Cleo suggests deleting all of your Cleo app messages. This deletes any mention of balances, budgets, and income. Additionally, change your Facebook and Cleo passwords. By changing your Cleo password, you prevent any unauthorized access to your Cleo dashboard.

Is It Worth It?

The free version of Cleo may seem like a no-brainer. Of course, as with any service, you are giving up some of your information. That is the trade-off we all face when using most free services. Cleo does say it takes steps to protect your data.

As for Cleo Plus at $5.99/month, most banks offer overdraft protection for free. Cleo Plus does have a rewards program. But at $5.99/month, does it beat the rewards program offered by your credit card company, which doesn’t cost anything? And if you want the cash advance/overdraft feature, there are other products that offer this.

For those reasons, Cleo Plus may have a tough time justifying its value.

Cleo Review

-

Pricing

-

Ease of Use

-

Customer Service

-

Services

Overall

Summary

Cleo is a cash and paycheck advance app.

Pros

- Get a paycheck advance of up to $100

- Simple budgeting features

Cons

- You must subscribe to Cleo Plus to get access to cash advance

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Chris Muller