Guideline wants to help Americans retire successfully by helping employers create simple, hassle-free 401k plans for their employees.

The company focuses on making the historically complex product into something small business owners can create quickly.

If you’re a small business owner looking to start a 401k plan, Guideline may offer the simplest, lowest-cost option for you. Here’s what you need to know about it.

Quick Summary

- Low-cost 401k plans for small businesses

- Employers pay a flat monthly fee plus cost per employee

- Offers Safe Harbor 401ks and allows Roth contributions

Guideline Details | |

|---|---|

Product Name | Guideline 401k Plans |

Account Type | Traditional 401k, Roth 401k, Safe Harbor, |

Employer Pricing | Starting at $49/mo + $8 per active participant |

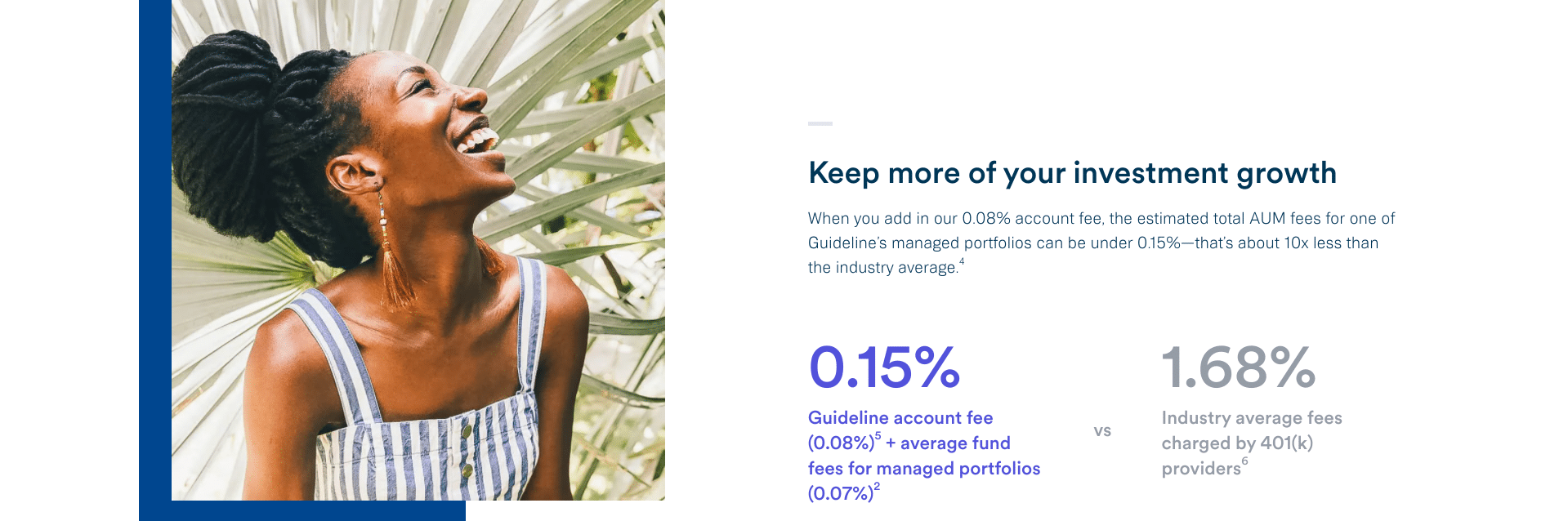

Employee Pricing | 0.08% AUM + 0.07% average fund fees |

Promotions | None |

What Is Guideline?

Guideline was founded by Kevin Busque who previously founded TaskRabbit. He started the company when he found that 401k participation at his company was low due to a confusing onboarding process. After realizing that, he built a new team and founded Guideline.

Since its founding in 2015, Guideline has been using technology to handle 401k plan management for small business owners. Guideline frees up employers to manage their companies while it deals with nitty-gritty plan details. The company now manages more than 25,000 plans and has more than $4.5 Billion in assets under management.

As a low-priced leader in the 401k plan space, Guideline makes it easy for small business owners to create an attractive 401k at a reasonable price.

What Does It Offer?

Guideline’s primary product is 401k plans for small and medium-sized companies (it's currently beta testing SEP IRAs). The company owns every aspect of 401k management from employee onboarding to IRS compliance testing. These are a few of the most important features:

Employee Onboarding

Employers who use Guideline don’t have to worry about onboarding employees into the plan. Guideline sets up employee accounts and provides them with login information. It also manages automatic enrollments and default contributions if an employer chooses to use them.

Option For An Employer Match And Profit-Sharing

Guideline’s basic plans don’t allow for an employer match, but its middle pricing tier (Flex) allows employers to implement profit sharing and matching options. The most expensive tier (Max) allows for custom features like comparability profit sharing.

Payroll Integration

Guideline offers payroll integration with major payroll software services including Quickbooks, Gusto, Square Payroll, and other providers. With Guideline, employee and employer contributions are automatically deducted with each payroll run, and employees can simply and easily change contributions through the Guideline website.

Record-Keeping

Guideline automatically tracks 401k plan balances, transactions, and deferrals. This allows Guideline to file annual Form 5500 and Form 8955-SSA with the Department of Labor and the IRS. It also sends form 1099-R to all plan participants.

Aside from filing the necessary paperwork, Guideline presents personalized information through Employee- and Employer-facing dashboards.

Safe Harbor 401ks

To stay in compliance with the IRS, plan owners must pass certain nondiscrimination tests. “Safe Harbor Plans” are 401k plans that automatically pass most IRS non-discrimination tests.

Guideline provides Safe Harbor 401ks right out of the box with its base tier (Core). The middle pricing tier (Flex), meanwhile, gives employers the option to choose between a traditional 401k and a Safe Harbor 401k.

Plan Fiduciary

Guideline serves as a plan fiduciary for all employers. The company also files select statements with the IRS and the Department of Labor on behalf of employers.

Managed Portfolios

Guideline recommends investment allocation for employees based on their age and risk tolerance. But employees can deviate from the recommendation and choose among 40+ low-cost mutual fund options. Guideline will automatically rebalance on behalf of employees.

Plan Features Managed By Guideline

Employers can choose whether to enable Roth contributions to the 401k plans. If an employer allows Roth 401k contributions, Guideline manages the contributions. Guideline also manages plan loans for participants and hardship withdrawals.

Are There Any Fees?

Yes, both participating employees and their employers pay fees to Guideline. Here's how they break down:

Employee Pricing

Employees who participate in a Guideline 401k will pay 0.08% of their assets annually plus the expense ratio on the funds they choose. The funds that Guideline offers are very low-cost with average fees of just 0.07%.

Terminated accounts will pay $4 per month after 90 days of termination. These fees are charged directly to employee accounts.

Employer Pricing

Below are the fees for employers and the services provided.

Core | Flex | Max | |

|---|---|---|---|

Price | $49 per month + $8 per month per active participant | $79 per month + $8 per month per active participant | $129 per month + $8 per month per active participant |

Features |

|

|

|

How Does Guideline Compare?

Guideline is a low-priced leader in the 401k plan space. The company keeps prices low for both employers and employees. Its technology-first approach allows the company to automate away the hassle associated with plan setup and administration. Small business owners who need a 401k plan should consider Guideline.

However, Guideline has some drawbacks. For one, the company only allows investors to choose from mutual funds. Employers who want plans that support individual stock investments will need to look at another company (Employee Fiduciary and Ubiquity both provide this option). Also, there certain situations where other providers may cost less than Guideline, especially for companies with fewer than 30 employees.

Header |  |  |  |

|---|---|---|---|

Startup Fee | Unclear | $500 to $1,500 | $500 for new plans $1,000 for conversions |

Employer Fees | Starting at $49/mo + $8 per employee | Starting at $120/mo + $4 per employee | Starting at 1,500/yr + 0.08% AUM Base Fee covers up to 30 employees |

Employee Fees | 0.08% (plus fund fees) | 0.50% (plus fund fees) | None |

Cell |

How Do I Open A Plan?

If a small business owner wants to learn more, Guideline allows employers to see a demo before creating an account.

However, employers that want to create an account must provide an Employer ID, an email address for the person associated with setting up the plan, and details about related entities. Owners also need to provide details about their payroll system, payroll frequency, and other details.

Once that information is provided, the small business owner can design their 401k plan and finalize the setup through e-signatures. Customer support can help if you have trouble along the way.

Is It Safe And Secure?

Guideline is first and foremost a technology company. It takes data security very seriously and has protocols in place for encryption, blocking attacks, and preventing malicious data entry. The company is held to the strictest security standards, and it appears to go above and beyond to protect all personal information.

Guideline uses Benefit Trust Company as a Custodian to hold assets for plan participants. This allows the assets to remain secure.

Overall, Guideline takes all reasonable steps to keep data secure. However, employees who invest in a Guideline 401k may experience investment losses or market volatility. Investing always carries risks, including the risk of loss of money.

How Do I Contact Guideline?

Guideline has three headquarters locations across the United States and US-Based customer support. Its primary headquarters is in Austin Texas with a street address of 1645 E 6th Street Suite 200, Austin, TX 78702.

To reach customer support, you can email hello@guideline.com or call 1-888-228-3491.

Is It Worth It?

Guideline is one of the lowest-cost 401k plan providers for small business owners. Its plans aren’t as specialized as some other plan providers (for example, employees can’t pick individual stocks), but the execution is solid and the price is tough to beat.

Employers who want to avoid 401k plan headaches can rely on Guideline to manage all the nitty-gritty for them. Small business owners seeking a straightforward 401k plan that won’t bog them down in administrative hassle should consider Guideline for plan administration.

Guideline Features

Account Types |

|

Employer Pricing |

|

Employee Pricing | 0.08% AUM + 0.07% average fund fees |

Self-Directed Investing | Yes |

Managed Portfolios | Yes |

Profit Sharing | Yes, on Flex and Max plans |

Supported Assets | Mutual funds only |

Integration Partners | 350+ |

Local Offices | None (online-only provider) |

Customer Service Number | 888-228-3491 |

Customer Service Hours | Monday - Friday, 6 AM - 4 PM (PST) |

Mobile App Availability | No |

Web/Desktop Account Access | Yes |

Promotions | None |

Guideline 401k Review

-

Pricing and Fees

-

Account Types

-

Investment Options

-

Customer Service

Overall

Summary

Guideline offers Safe Harbor and Traditional 401k plans that are low-cost and allow pre-tax or Roth contributions.

Pros

- Low-price leader

- Employee payroll integration

- Automatically serves as fiduciary

- Employees can contribute with pre-tax or Roth dollars

Cons

- Must upgrade to Flex tier to add employer matching

- Both employees and employers pay fees

- Employees investment options are limited to 40+ index funds

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Chris Muller